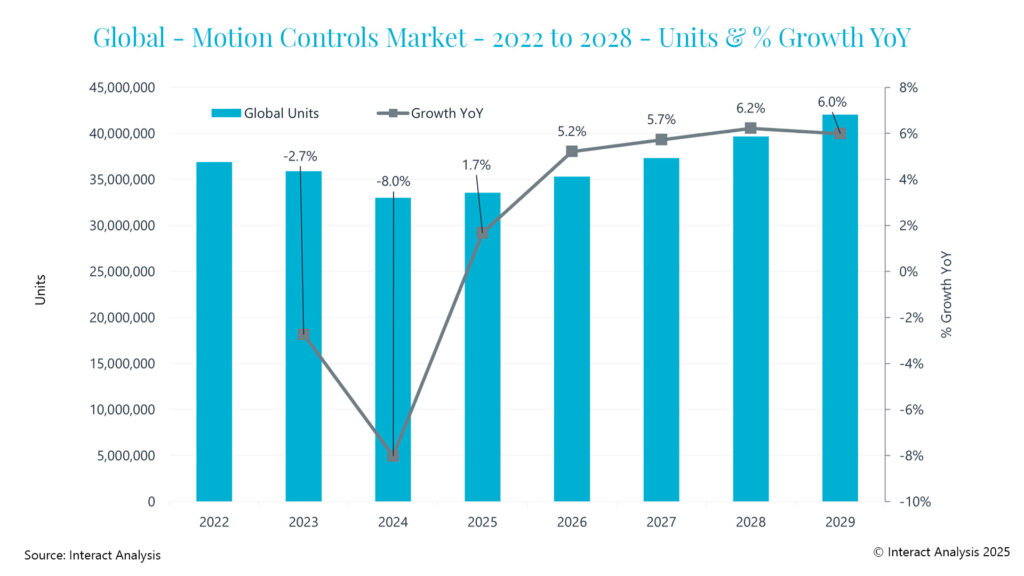

• The global motion controls market contracted by -7.0% in revenue terms during 2024

• A period of over-ordering in 2021 and 2022 and destocking thereafter impacted the market

• EMEA only region expected to see motion controls market contract in 2025

London, 18th February 2025 – The global motion controls market contracted by -7.0% in revenue terms during 2024, according to market intelligence specialist Interact Analysis. This follows a significant period of growth for the motion controls market between 2020 and 2023. Soft manufacturing demand was the primary cause of the decline. However, destocking by customers and channel partners following over-ordering in previous years also contributed substantially to a decrease in revenue seen during 2024.

Motion controls revenues fell sharply in 2024, with the market expected to return to growth (albeit slight) in 2025.

The impact of over-ordering and destocking on the motion controls market

The motion controls market saw widespread over-ordering and overstocking in 2021 and 2022. This was due to the Covid-19 pandemic driving supply chain disruptions and causing shortages. The result was panic buying, where customers placed big orders to secure the products they needed. This has led to market-wide destocking since mid-2023, as companies altered their normal ordering habits instead choosing to use stock accumulated during the period of panic buying. Channel partners and customers halted orders with the aim of reducing their inventories, and this contributed greatly to the 2024 market contraction.

Market performance varies across regions

Overall, motion controls market growth dipped globally during 2023 and 2024. However, the market performance was mixed across the regions. The Americas performed best, although the market there still declined by -1.1% in 2024. Softening interest rates and the US election taking place have reduced economic uncertainty which is expected to help reverse the dip. After a period of decline, it is projected the Americas will be the highest growing region in 2025, with an expected motion controls market growth rate of 3.5%.

On the other hand, the EMEA region was the worst performing region in 2024, with a market contraction of -13.5% in revenue terms. Ongoing conflicts, including the war in Ukraine, and the poorer performance of key markets for motion products such as Germany and Italy, have caused an economic downturn which Europe has been unable to shake off. Interact Analysis projects that the EMEA region will continue to perform poorly during 2025.

The future of the market is more positive

While the motion controls market has experienced the worst year in a decade, better times are around the corner. There is significant growth in the <60 V range of motion control products, which has been caused by rapid growth in the mobile robots market, increasing use of small payload industrial robots, and the general increase in industrial automation. Interact Analysis predicts that new vendors that haven’t been active in the traditional motion controls market will also start to offer solutions.

Commenting on the latest motion controls forecast, Tim Dawson, VP Industrial Automation at Interact Analysis, says, “This is a unique situation for the motion controls market. The market is usually closely correlated with manufacturing production indices. However, amid heavy destocking, we have seen significant declines in the revenues of motion control suppliers despite seeing only slight declines (and in some cases growth) in manufacturing production. This de-coupling of manufacturing production and the motion control market growth is temporary, and we believe it will come in line again once inventories are brought to more normal levels and orders resume.”