By Samantha Mou, Research Analyst

As a Research Analyst based in China, Samantha provides support in the Industrial Automation sector. Samantha brings with her a master’s degree in economics, and has experience, whilst working in Germany, conducting market research in Industrial Equipment and Automobile Components.

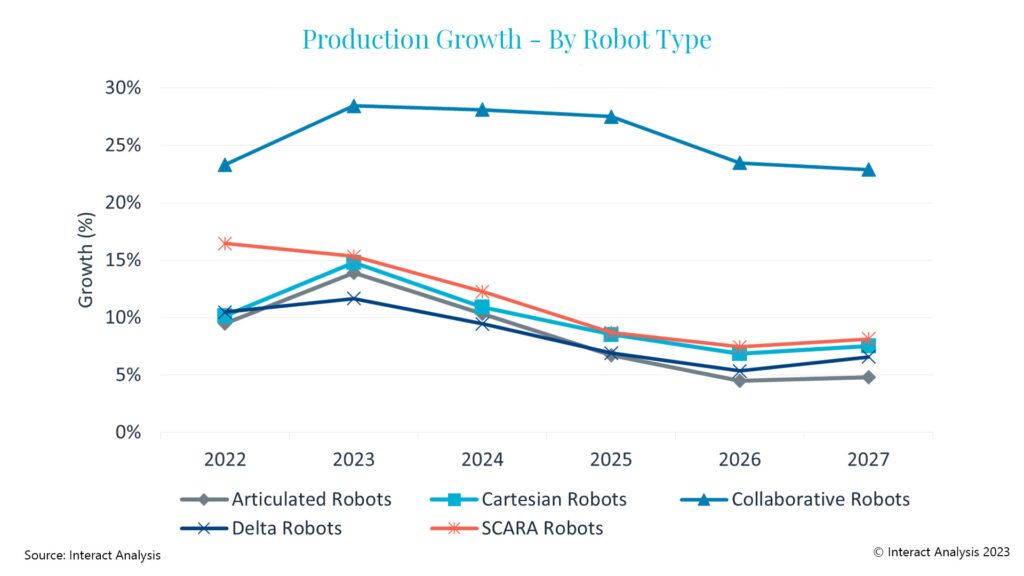

The global market for key components used in industrial robots reached $12.1 billion in 2022, a year-on-year increase of 14.7%, driven by production of collaborative and SCARA robots. The growth of the components market will likely slow down over time, as the robot market matures and stabilizes. Overall, the market for industrial robots components is expected to grow at a CAGR of 8.8% from 2022 to 2027.

Key components included in the market size statistics include motors, servo drives, precision gearboxes, encoders and sensors, robot controllers, end effectors, machine vision hardware and teach pendants used in industrial robots, and collaborative robots.

Growth driven by surge in collaborative robots and SCARA robots

Production of Collaborative Robots and SCARA Robots Grows Fastest

Demand for collaborative robots in industrial applications increased rapidly during the past two years and the momentum is expected to continue during our forecast period out to 2027. The growth is fuelled by the ease of use of collaborative robots and the increase in human-machine collaboration scenarios in industrial production. Moreover, the market for high-payload collaborative robots is growing faster, competing with traditional articulated robots.

Production of SCARA robots is expected to grow with the second highest CAGR among the five robot types. Demand for SCARA robots has been affected by the weak semiconductor and consumer electronics sectors since 2021, but this negative impact has been offset by demand from the surging new energy industry, such as lithium-ion battery manufacturing and photovoltaics. Similar to trends in the collaborative robot market, SCARA robots are also moving toward larger payloads to meet the efficiency requirements of battery manufacturing applications.

As a result, sales of components used in collaborative robots and SCARA robots are set to grow at the fastest rate, with expected 5-year CAGRs of 25.1% and 9.0% respectively. In comparison, of the five robot types, the component market for delta robots is predicted to grow most slowly, with a forecast CAGR of 6.9% from 2022 to 2027.

The markets for force and torque sensors, and strainwave gearboxes will particularly benefit from the surge in demand for collaborative robots and SCARA robots. In 2022, 35% of sales of force and torque sensors were estimated to come from products paired with collaborative robots, and this proportion is expected to rise to 54% in 2027. Strainwave gearboxes are used in more than 95% of the axes of collaborative robots and SCARA robots. However, as the two types of robots move toward larger payloads, cycloidal gearboxes are also witnessing increasing market penetration. For example, SCARA robots with payloads exceeding 20kg require cycloidal gearboxes to achieve the acceptable level of rigidity and lifecycle.

Prices of key components continue to decline

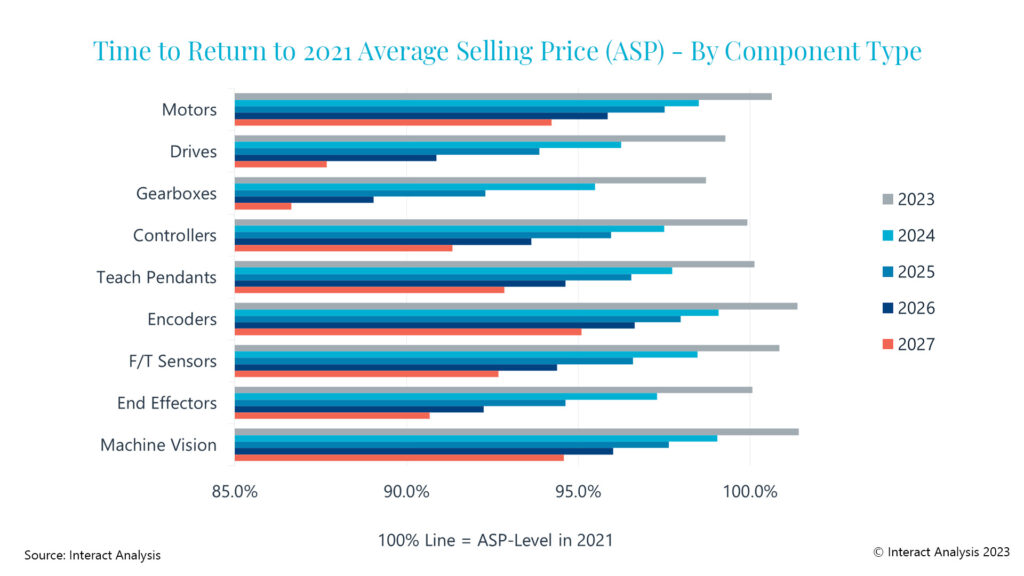

In 2022, price increases for key components in industrial robots were prevalent in all major regions, due to supply chain disruptions, chip shortages, increased raw material prices and inflation. The prices of like-for-like components rose by 5%-7%, but the overall average selling price increase was partially eroded by the entrance to market of new suppliers with lower prices, as well as the scale effect caused by increased numbers of component units purchased to meet higher levels of robot manufacturing.

As inflationary pressures gradually dissipate, we expect price erosion from competition to accelerate from 2023 onwards. On average, the selling prices of key components used in industrial robots are predicted to decline by about 1% each year starting from 2024. Among all component types, the average price of gearboxes is projected to decline the fastest owing to intensive competition and increasing shipment numbers of strainwave gearboxes, which face the greatest price pressure.

Average Selling Prices of Industrial Robot Components Are Expected to Fall

Non-standard integrated robots represent opportunities for growth

In our research, we noticed increasing interest from component suppliers in the market for non-standard robots manufactured by machine builders (OEMs) and integrated into machines. Unlike the market for traditional ‘off-the-shelf’ robots, the non-standard integrated robot market is seen by component suppliers as an emerging market with great potential and new business opportunities. First, machine OEMs tend to be more flexible in component selection than traditional robot vendors. For example, servo systems for integrated robots are often just generic products from industrial automation suppliers, rather than the custom, robot-specific motors and drives usually required by robot vendors. Second, and as a result, the supply chain for integrated robots is more ‘open’ and competitive than that of standard robots. In the traditional robots’ components market, more than half of the motors and drives used are supplied by robot vendors themselves (we call it a ‘captive’ market), so that component suppliers find it very difficult to gain market share despite the overall large market size.

Moreover, demand for integrated robots is emerging and expected to grow fast. OEMs are attracted by the benefits offered by these robots, such as flexible kinematics, machine-integrated centralized control and easier operation. Currently, we observe most cases of non-standard robots integrated in packaging machines, although the penetration rate is still minimal. However, the advantages of self-built robots are increasingly coming to the attention of machine builders in a variety of industries, so this market’s growth potential is huge.

The industrial robots and components discussed in the report all refer to the ‘off-the-shelf’ standard robot market because integrated robots currently still present such a small part of the total industrial robot market. However, we will keep paying attention to the development of this market as its share of the traditional market is expected to grow over time.