By Jonathan Sparkes, Research Analyst – Interact Analysis.

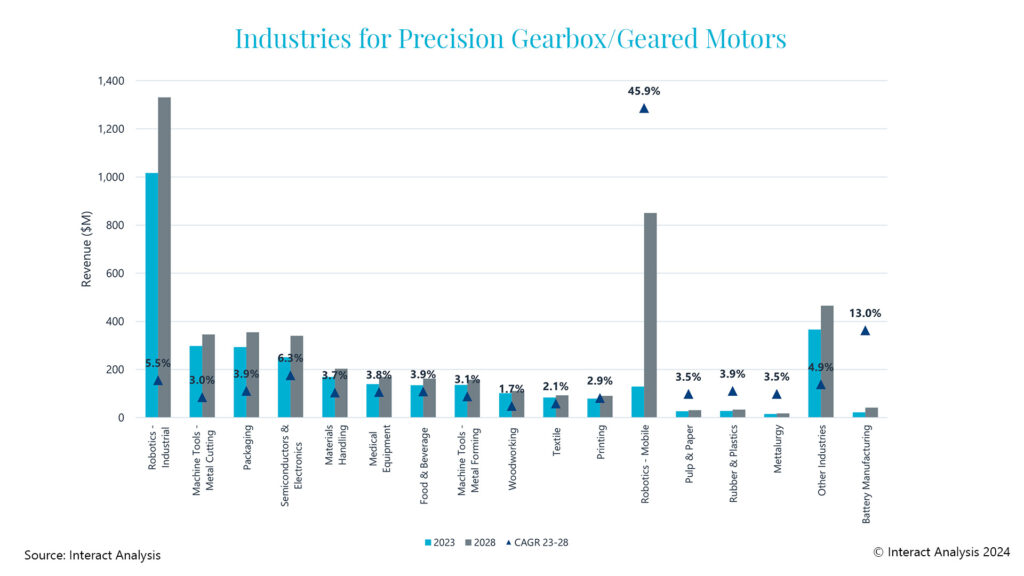

The global market for Precision gearboxes and geared motors used in mobile robots is predicted to have a CAGR of 45.9% out to 2028, this large growth will far outperform the wider automation market. Planetary precision gearboxes and geared motors will be the gearbox with the largest growth.

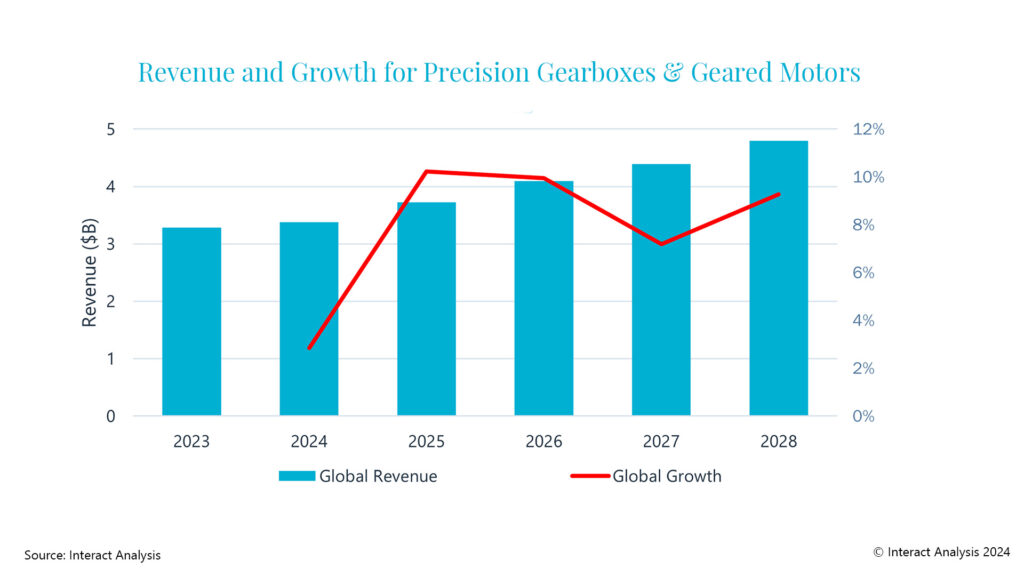

The global precision gearbox and geared motors market is expected to generate revenue of $3.4 billion in 2024, which is up 2.9% from 2023. However, over the next five years we predict a steady growth rate of 7.9%, with 2025 expected to be a strong rebound year and offering the biggest annual growth (10.2%). This is expected to drive growth in the global precision gearbox and geared motors, which is forecast to increase from $3.3 billion in 2023 to $4.8 billion in 2028, with a compound annual growth rate (CAGR) of 7.9%. The largest growth overall is attributed to planetary precision gearboxes and geared motors, where we anticipate a CAGR of 10.2%, taking revenue from $1 billion in 2023 to nearly $1.8 billion in 2028.

Global precision gearboxes and geared motors has growth of 7.9% over the next 5 years

Definitions are provided below for coaxial planetary precision gearboxes and geared motors, both of which are covered in this insight and also in the Precision Gearboxes and Geared motors 2024 report, from which the data and analysis outlined here is taken:

Coaxial Planetary Precision Gearboxes: these comprise a sun gear, planetary gears & carrier; and satellite gear. Examples include the CP series (Wittenstein) and P series (Stoeber).

Coaxial Planetary Precision Geared Motors: a combination of planetary gearbox and servo motor. Examples include the PS.F series (SEW Eurodrive) and SIMOTICSS-1FK2 (Siemens).

Planetary gearboxes do not offer the highest levels of precision, found with devices such as strainwave and cycloidal precision gearboxes (which most commonly have a backlash of <1 arc minute). However, they still have very low backlash ratings, which makes them a cheaper and efficient alternative, especially in mobile robots where the “smoothness” of their acceleration and motion can be a benefit.

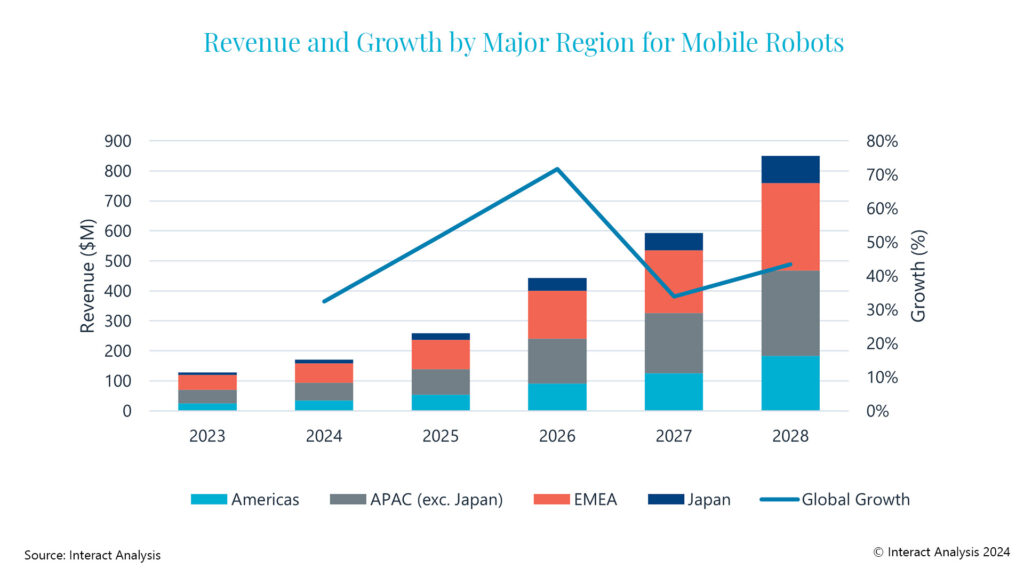

The mobile robot market has continued to outperform most other industries in recent years and the growth and appetite does not seem to be as heavily affected by the slowdowns felt in other industries. Our forecast for the mobile robots market has dampened from previous years, but we still expect to see consistent growth of between 30-50% out to 2028.

Planetary gearboxes and geared motors will continue to benefit from this substantial growth. With all major regions showing significant growth out to 2028, we predict Japan will benefit from the highest CAGR (60.2%), followed by the Americas (49.5%), APAC (44.3%), and then EMEA (42.3%).

We forecast the global market for precision gearboxes and geared motors in the mobile robots market to grow from $129 million in 2023 to over $850 million in 2028.

Precision gearbox and geared motors to benefit from continued growth in the mobile robots industry

Fixed industrial robots and cobots remain the dominant sectors

While mobile robots offer by far the strongest growth potential for precision gearboxes and geared motors, it would be remiss not to discuss the industrial robots industry, as this is by far the most important largest user of precision gearboxes. Prior to a slowdown in 2022 and 2023, industrial robots and collaborative robots experienced strong growth and this led to strong growth for the precision gearbox and geared motors market.

The global market for precision gearboxes used in industrial robots was worth just over $1 billion in 2023, and we forecast this will grow to over $1.3 billion (with a CAGR of 5.5%) for the period to 2028. Once one of the biggest growth industries for precision geared products, we now believe that the global market for industrial robots and cobots has slowed considerably since 2022. Most industrial robots consume 6 precision gearboxes, with larger axes serving bigger payloads generally consuming cycloidal gearboxes, and the smaller axes and lower payloads consuming strainwave gearboxes. If substantial growth returns in this industry in the future it will stimulate sharp growth once again in the overall precision gearbox and geared motors market.

Definitions are provided below for coaxial cyloidal and coaxial strainwave precision gearboxes and geared motors, both of which are covered in this insight and also in the Precision Gearboxes and Geared motors 2024 report, from which the data and analysis outlined here is taken:

Coaxial Cycloidal Precision Gearboxes: these comprise an input shaft, an eccentrically mounted bearing, a cycloidal disc (or discs), ring pins and output rollers and shaft. Examples include RDS-E (Nabtesco) and the TS series (Spinea).Coaxial Strain Wave Precision Gearboxes: these comprise a rigid circular spline, flexible internal spline and wave generator; also referred to as harmonic gearboxes. Examples include CSG-2UH (Harmonic Drive) and Flexwave (Nidec).

Industrial robots is the largest industry for precision gear products, but for how long?

Although precision geared products still remain tightly aligned with the industrial robots industry, it is clear that mobile robots offer the largest growth potential currently for this market. Companies active in the planetary gearbox market will have the best exposure to this as they are the main gearbox type utilized by the mobile robot market.

One final thought, however, is this; if humanoid robots find a place in industry, then this could also serve as a large potential growth driver for precision gearboxes – as it’s believed that even the simplest humanoid robots would likely utilize a minimum of approximately 30 precision gearboxes (although some other humanoid robots currently in development are cited to have closer to 80 precision gearboxes inside). What products will be best suited to this application and which companies will be able to win in this market still remains to be seen.

Data on the precision gearbox and geared motors market is available now in our updated Precision Gearboxes & Geared Motors – 2024 report, which has just been published. The report and accompanying data set provide the most granular data on the precision gearboxes and geared motors market ever produced. We look at the market for 12 primary products, in 17 different end industries, for 6 different backlash ratings and for 39 different countries. We supply this data in terms of revenues, units shipped and ASP’s.