Headline performances: –

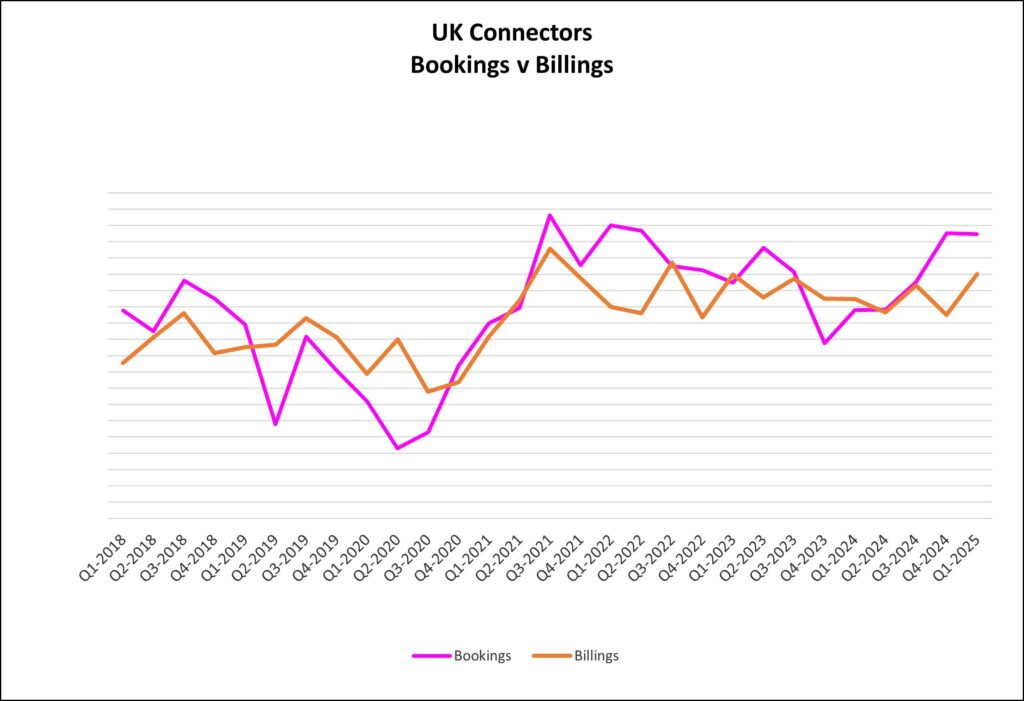

• Revenues up 11% yoy and orders flat yoy

• Order intake in Q1 of 2025 was the second highest since Q2 of 2022

• B to B remained positive at 1.10:1 but were flat as a trend.

• There were some significant variations in market performance.

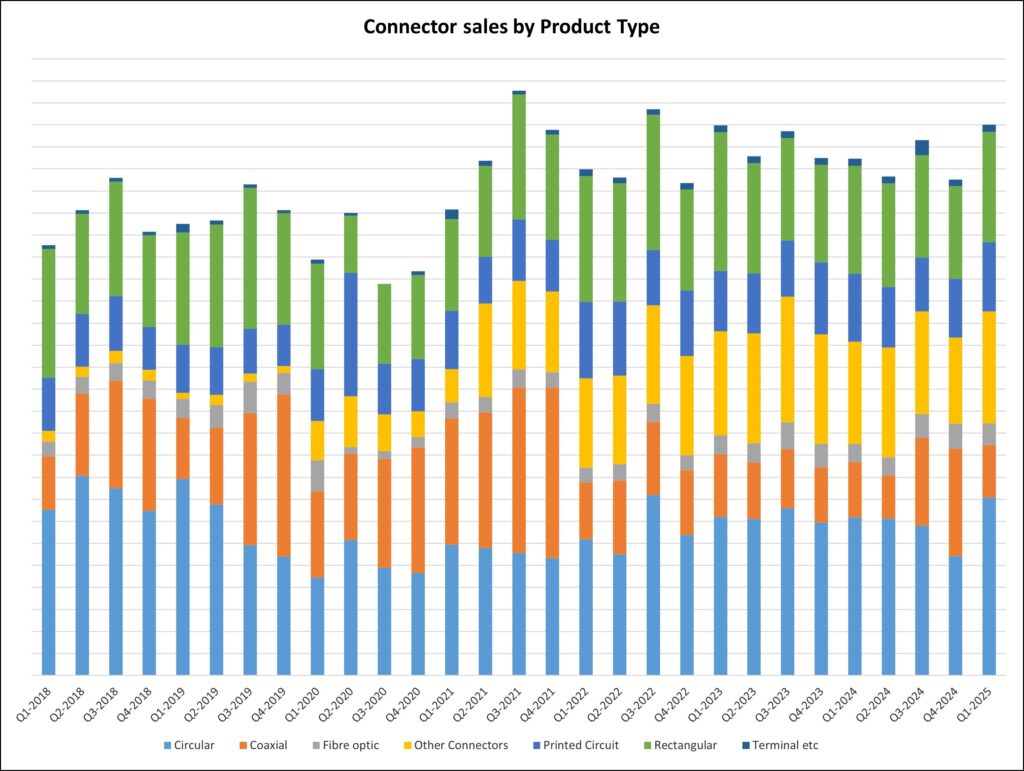

• Markets: –

• Broadcast down 16% but this is against a backdrop of significant spend in 2024.

• Mil/Aero 24% (this is a significant increase over 2024 and was the highest revenue level since the end of 2023)

• Medical up 9%

• Communication down 9%

• T&M down 14% (T&M sales have been falling for two consecutive quarters)

• Mass Transport up 71% (This is linked to key rolling stock and infrastructure projects)

• Data Processing saw a jump of 52% on the back of key datacentre projects.

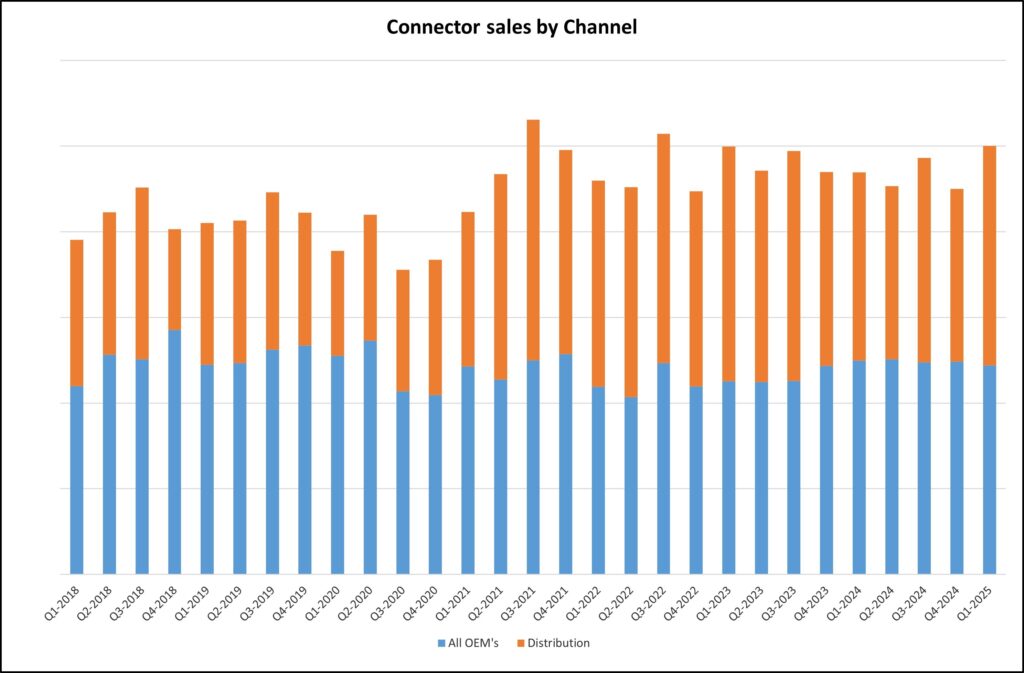

• Distribution strengthened significantly with an increase of 21%. As this remains a significant part of members revenues it is a good sign.

Looking at the results of members performance in Q1 of 2025 we could be forgiven for thinking that everything was rosy in the interconnect world, revenues are up 11%, book to bill is positive at 1.10:1 and overall markets are holding up well, however, we have to take this in the context of the first two weeks of April where the world has been shaken by the significant tariffs being imposed on the rest of the world which is definitely not reflected in the data yet.

What we have already seen is a significant increase in defence spending which is reflective of the continuing war in Ukraine and elsewhere in the world and probably some pre-emptive spending with the expectations that Europe is going to have to fend for itself more and not rely on the US.

We think that the second quarter will be far more reflective of the world as it will exist for the near future and members are naturally extremely cautious.

At the end of 2024 ITSA was projecting a flat or low digit growth in the UK connector market for 2025, however, with the recent events it would not be a surprise to see a shrinking of the UK connector market in 2025, we will have to revisit this as we move into the next six months.

The unpredictability of the US imposition of tariffs (is it 10%, 25%, 145%, exempt!!!) is causing global uncertainty and here in the UK this coupled with the increase in minimum wage and NI plus a very low growth (if any) economy is certain to have a negative effect on business even if this is in the short term.

With all the global uncertainty, supply chains are having to be revisited to try and offset some of the negative impact, but this obviously takes time and sensitive negotiation.

As reported at the end of 2024 the level of RFP’s etc carried over into 2025 has helped in holding up Q1 and with a current positive BtoB there are some faint signs of hope.

S&P Global/CIPS UK Manufacturing PMI (This report was released prior to the latest tariff announcements from Donald Trump)

UK manufacturing production contracts at faster pace as new orders decline at sharpest rate for 19 months Manufacturing PMI falls to 17-month low of 44.9 Business optimism at weakest level since November 2022 Steeper drops in output, new orders, and new export business. The end of the opening quarter saw the downturn at UK manufacturers deepen. Rates of contraction in output and new orders accelerated, as the difficult operating environment persisted. Business confidence slumped to a near two-and a-half year low, as concerns about government policy, rising costs, increased geopolitical tensions and potential tariff uncertainty impacted on both current and expected future conditions.

The seasonally adjusted S&P Global UK Manufacturing Purchasing Managers’ Index™ (PMI®) fell to a 17-month low of 44.9 in March, down from 46.9 in February but slightly above the earlier flash estimate of 44.6. The PMI has now signalled a deterioration in overall operating conditions in each of the past six months.

March saw UK manufacturing production decline for the fifth straight month and at the quickest pace since October 2023. The downturn was widespread, with contractions signalled across all sub-sector definitions (consumer, intermediate and investment goods) and all size categories (small, medium, and large).

Small-scale producers saw the steepest decrease in output. By far the most significant factor underlying the retrenchment in production volumes was a slump in the level of new business received during March. New order intakes fell to the greatest extent for over one-and-a-half years (since August 2023) and at one of the quickest rates since the pandemic and lockdown affected months of 2020.

The 6.9-point drop in the New Orders Index since February was also the joint-sharpest fall since 2020, further emphasising the severity of the acceleration in the pace of decline. Manufacturers reported a tough trading environment, beset by rising geopolitical tensions, weak client confidence and economic slowdown in both domestic and overseas markets.

Disruption to new order inflows was also caused by concerns about the forthcoming rises to the national minimum wage and employer national insurance (especially related to the cost implications for manufacturers and their clients alike) and the possibility of tariffs. New export business contracted for the thirty-eighth successive month in March, and at the quickest pace since “March proved to be another tough month for UK manufacturers.

Output contracted at the quickest pace since October 2023, as new business growth fell at the steepest rate for one-and-a-half years, suffering one of its sharpest falls since the pandemic lockdown of 2020. “Companies are being hit on several fronts. Many reported that domestic market conditions are deteriorating, costs are rising due to changes in the national minimum wage and national insurance contributions, geopolitical tensions are intensifying, and global trade faces potential disruptions from tariffs. “Although the impact on production volumes was widespread across industry, it was again small manufacturers that took the hardest knock.

“The outlook is also darkening, with overall business optimism plunging to its lowest levels since late-2022. Fears about current and future performance put manufacturers on an increasingly cost cautious footing, with employment, stock holdings and purchasing all falling as companies looked to work leaner and protect cash flow, margins, and competitiveness.

Many firms are clearly hunkering down as they expect difficulties to continue in the coming months.” Lower intakes of new export work were mainly linked to weaker demand from the US and Europe. Some firms also noted reduced levels of new business from China, India, and the Middle East. The weaker economic backdrop combined with rising uncertainty regarding the future had a severe impact on business confidence among manufacturers during March.

Optimism slumped to a near two-and-a-half year low, with only 44% of companies expecting activity to rise over the coming year (down sharply from 56% in February). Manufacturers expressed concerns around government policy (particularly the effects of national minimum wage and national insurance increases), rising global and trade tensions, cost increases, economic slowdown, recession fears and gloomy client confidence.

Cost-caution also remained pervasive among UK manufacturers in March, leading to cutbacks in employment, stock holdings and purchasing activity. Staffing levels have been reduced for five consecutive months, although the rate of job losses eased noticeably since February’s near five-year record. Cuts were linked to the economic backdrop, rising costs, non-replacement of leavers, redundancies and hiring freezes.

Some reductions to headcounts reflected efforts to cut excess capacity, highlighted by a further marked reduction in backlogs of work at factories. March saw the rate of input price inflation ease slightly from February’s 25-month high. There were reports of higher costs for chemicals, electronics, energy, metals, packaging, paper, timber, and transportation as well as suppliers passing on increases to their own cost bases. Factory gate selling prices meanwhile rose at the quickest pace since April 2023

Make UK report. (Released in mid March prior to the announcements on tariffs)

Britain’s manufacturers have hit the brakes on recruitment and investment plans amid rising employment taxes and business costs, according to Make UK and BDO’s Q1 2025 Manufacturing Outlook report.

It reveals that the final quarter slump in business confidence in 2024, the fastest rate of decline since the pandemic, has now translated into a fall in both output and orders in Q1 2025. It is the first time in a decade that output has fallen in the first quarter of the year, as both domestic and export orders have slowed.

In response, half of companies have frozen recruitment efforts, with more than a quarter considering redundancies. A third of companies have also delayed investment plans.

These factors have led Make UK’s economics team to downgrade manufacturing sector growth forecasts for this year, with an expected contraction of -0.5% in 2025, down from the previous forecast of -0.2% in the last quarter, before growing by 1% in 2026.

Summary

We entered 2025 on a positive trend with good order books, a positive BtoB and good revenues. Members companies continue to innovate and invest and had a positive outlook, however, this has all been thrown into question in recent weeks and there is still no indication as to when, or indeed, if the situation will improve or stabilise.

What it has done is to show that Europe needs to be far more independent of the US than in recent years.

The US will continue to be an important market for all our members, but geographic strategies may well need adjusting.

The Interconnect market has proved resilient in the past and we see no reason as to why this should not be the case in 2025.

We will have to wait and see!!