The outlook for the global manufacturing industry looks uncertain in 2025, with political and economic events hampering growth. These include an escalating tariff war between the US and territories including China, Mexico and Canada, deindustrialization in some large European economies and the AI arms race. Amid the unpredictability, however, we have identified high growth potential among the manufacturing sectors in India and the ASEAN countries.

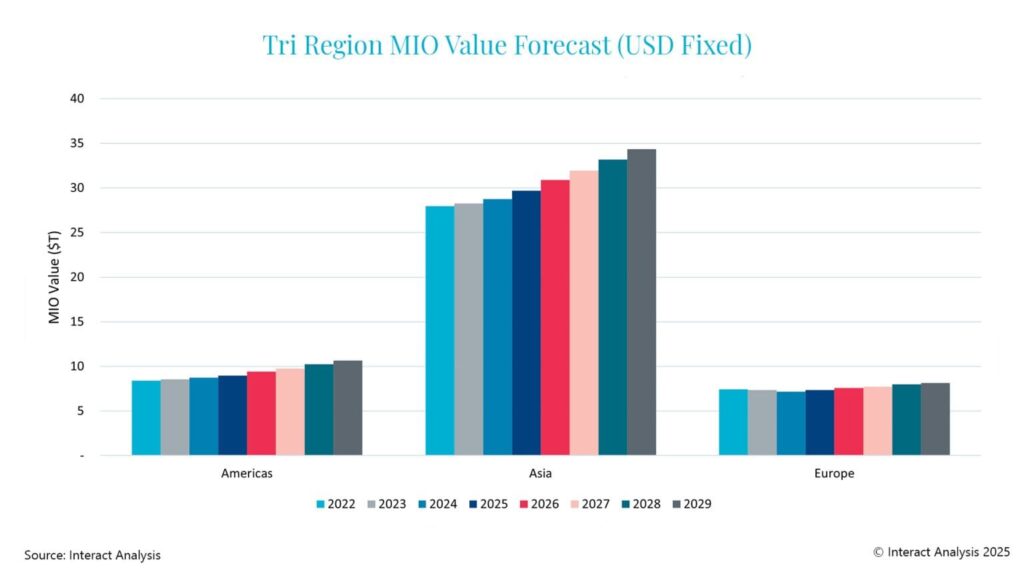

The events of 2024 and early 2025 prompted a reassessment of the tri-region forecast in our global Manufacturing Industry Output (MIO) Tracker. In Europe, stagnation among industrial giants – especially Germany – led to a steep downward revision. Despite high growth in ASEAN and tiger-cub economies, Asia (excluding China) also saw a pared-down outlook. And despite trade tensions between the US and China, both countries have maintained their positive manufacturing outlook. Our forecast for China’s manufacturing output remains mostly unchanged, while US manufacturing remains robust, with slow stable growth expected.

Steady manufacturing industry output growth is forecast in each of the Tri Regions sectors out to 2029

Europe’s manufacturing struggles: Risk factors and challenges for industrial giants

The European manufacturing sector continues to face a series of challenges, such as high energy prices, self-imposed environmental regulations, and rising labour costs, leading us to downgrade our forecast for the region. Europe’s four industrial giants – Germany, Italy, the UK, and France – have been struggling to remain competitive on the global stage. Deindustrialization is a real concern, with Germany’s large automotive manufacturing industry announcing plant closures, near-shoring and mass layoffs.

High growth potential in India and ASEAN countries, but potential threat from US-China trade war

As predicted, Asia has maintained a strong manufacturing growth rate, with particularly high growth potential identified in India and ASEAN countries. There is a significant focus in the region on semiconductor production and testing, with Singapore and Taiwan carving out niches for themselves in the sector, while India has invested $15 billion into the market and its union cabinet has approved a fifth domestic fabrication plant to increase its semiconductor manufacturing capability.

Vietnam, Indonesia, and Thailand all stand to benefit from the US searching for alternative trading partners. In fact, removing China (as well as Japan and South Korea) from Asian forecasts demonstrates the growth potential of emerging Asian markets – its compound annual growth rate (CAGR) out to 2029 increases from 4.5% to 5.3% CAGR. Future geopolitical events may have a substantial impact on emerging, ‘tiger-cub’ economies in Asia, especially if trade tensions between the US and China continue to escalate.

The tariff war between the world’s two biggest industrial superpowers – China and the US – is concerning for the rest of the global manufacturing sector. US customers may fare worse, despite the intention of these tariffs being to protect and grow domestic business. Increased prices and retaliatory tariffs on US imports could result in the US manufacturing economy being stifled by inflationary pressures and supply chain issues.

Presently, the US manufacturing industry is demonstrating resilience. After initially hitting a low point in 2024, the Americas region is expected to enjoy steady growth for the next five years. Despite the risk of volatility from trade tariffs and related policies, companies and customers may benefit from more business-friendly initiatives from the new US administration, such as the possible expansion of 2017 tax breaks and a reduction in regulations.

What remains to be seen is if instability will take root within the Americas itself, due to the threat of tariffs against the top US trading partners in the region – Mexico and Canada. Undermining the USMCA free trade agreement could gain the US a reputation as an untrustworthy trade partner, which might damage trade globally. Efforts to protect domestic business could also be squandered if Mexico imposes retaliatory import taxes on raw materials. Furthermore, Mexico-based US manufacturers could be forced to relocate back to the States, reducing their cut profits and disrupting efforts to reshore supply chains away from China. This could, ultimately, lead to China being positioned as a better trading partner than the US on the world stage.

Read more about the potential risks to the US economy and manufacturing of protectionist policies in an upcoming insight.

Conclusion

In conclusion, the longer-term growth trajectory appears to be steady, with our calculations suggesting year-on-year growth in global manufacturing output between 2025 and 2029 of 3% to 5%. Regarding Asia, some emerging economies within the region are experiencing strong growth. Simultaneously, China’s growth appears slower compared with recent history, as it becomes a much more developed economy. Europe is set to witness growth, albeit slower-paced due to deindustrialization in some of its larger states and economic stagnation. In contrast, the trajectory for the Americas region fluctuates more but is also stronger and more robust, while the forecast for manufacturing industry output growth in the region is almost double that for Europe.

Market intelligence for the entire automation value chain | Interact Analysis