• Independent survey commissioned by ABB highlights the critical role that energy efficiency now plays in the sustainability agenda for global businesses with 91 percent saying this influences their choice of electric motors

• 94 percent of companies surveyed are already investing, or planning to invest, in sustainability initiatives, and have adopted a strategy of reducing operating costs through energy efficiency solutions

New research by ABB, in collaboration with Sapio Research, has surveyed nearly 2,400 global businesses to gain insight into the state of the market around energy efficiency, sustainability, digitalization, and the key role played by electric motors. Conducted in June 2024, the research gathered responses from industrial decision-makers across the UK, US, Germany, Italy, France, Australia, UAE, Japan, Thailand, Saudi Arabia, Brazil, South Korea, and India. Respondents represented a range of industries, such as manufacturers of OEM machinery, energy/power, food and beverage, metals, and chemicals. A key finding was that 91 percent of businesses said that energy efficiency now had a critical influence on their choice of electric motors. Furthermore, 94 percent of businesses are either currently investing or planning to invest in sustainability initiatives.

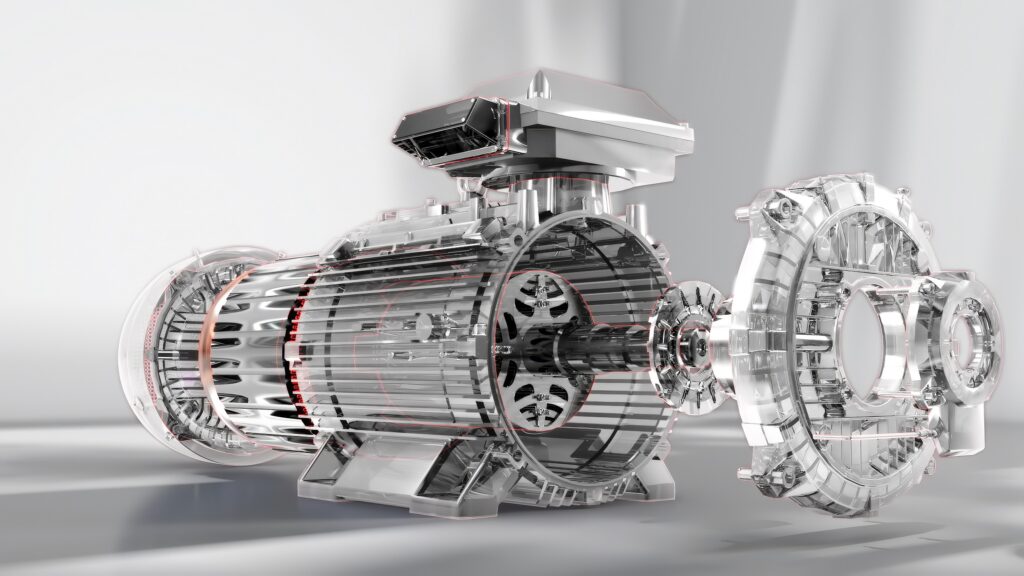

“This survey provides a valuable insight into how businesses are prioritising energy efficiency not just to meet sustainability targets but also to gain measurable financial returns, said Stefan Floeck, Division President IEC Low Voltage Motors, ABB Motion. “ABB is already playing a critical role in this development by demonstrating how investing in state-of-the-art energy-efficient electric motors, such as our IE6 SynRM technology, can enhance operational efficiency and promote sustainable growth. With payback periods often measured in months rather than years the result is a win-win for both the environment and the bottom line.”

The role of electric motors in energy efficiency

Nearly all businesses (94 percent) are investing or planning to invest in sustainability and especially energy efficiency. Most are aware of the role that energy efficient motors can play in achieving their sustainability goals, with 91 percent saying that this influences their choice. Nearly all businesses also recognise that energy efficient motors can add value to their products and business.

An emerging theme throughout the report is that end user businesses place a greater emphasis on sustainability, often due to increased pressure from customers which is reflected through their increased investment in energy efficiency. However, this also translates into what these businesses prioritise when it comes to energy efficient motors, with 88 percent considering it important that manufacturers can produce an environmental product declaration (EPD). ABB is addressing this development through EcoSolutions, a comprehensive program designed to provide complete transparency on the environmental impact of its products across their entire lifecycle, from inception through to disposal.

Barriers to adoption

The main barriers preventing businesses from investing in higher efficiency motors are seen as higher upfront costs, concerns around integrating with existing systems and potential disruption in production capacity. Higher upfront cost is more of a barrier for higher turnover businesses.

Cost plays a role as both a barrier and a driver due to the investments required for plant and equipment upgrades. However, 99 percent of businesses are now tracking the long-term savings as the main return on investment (ROI) from their energy efficiency initiatives.

Total cost of ownership (TCO) makes the case for energy efficiency

It is important to note that most businesses look at the total cost of ownership (TCO) as the most significant factor when purchasing new electric motors. In fact, over a long lifetime, the cost of an energy-efficient motor is far outweighed by the cost of the electricity to power it. For an IE6 SynRM, the upfront cost will be around 2 percent of its TCO, maintenance accounts for 1 percent and the remaining 97 percent is spent on electricity.

But it’s not all about cost. Quality and ability to integrate are also key attributes that businesses look for from a supplier.

Digitalization and E-commerce

Businesses are increasing their investment in innovative technologies to benefit from digitalization and E-commerce. What this investment is being spent on is multifaceted, but there is a focus on automation and AI-driven solutions.

When looking specifically at the digitalisation of electric motors, there is a clear trend for electric motor suppliers to utilise data insights and remote monitoring to improve their service offering. 99 percent of businesses believe there is added value in running digitally connected electric motors, specifically for their capability for predictive condition monitoring to enhance motor availability and safety.

Since many of the respondents are already using E-commerce there is growing interest for its use as a business-to-business service. Nearly all businesses see some benefit to electric motor procurement through E-commerce, with being able to see a great range of options and easy product comparison coming out on top. ABB has already deployed E-commerce in twenty-one countries with the confirmed advantages including speed, flexibility in product selection and ease of configuration, order confirmation and tracking.

These findings further strengthen the trend for digitalisation with even more reliable and precise solutions delivering operational value and enabling business model transformation.

More information about ABB’s ultra-efficient SynRM motors is available here: https://new.abb.com/motors-generators/iec-low-voltage-motors/process-performance-motors/synchronous-reluctance-motors