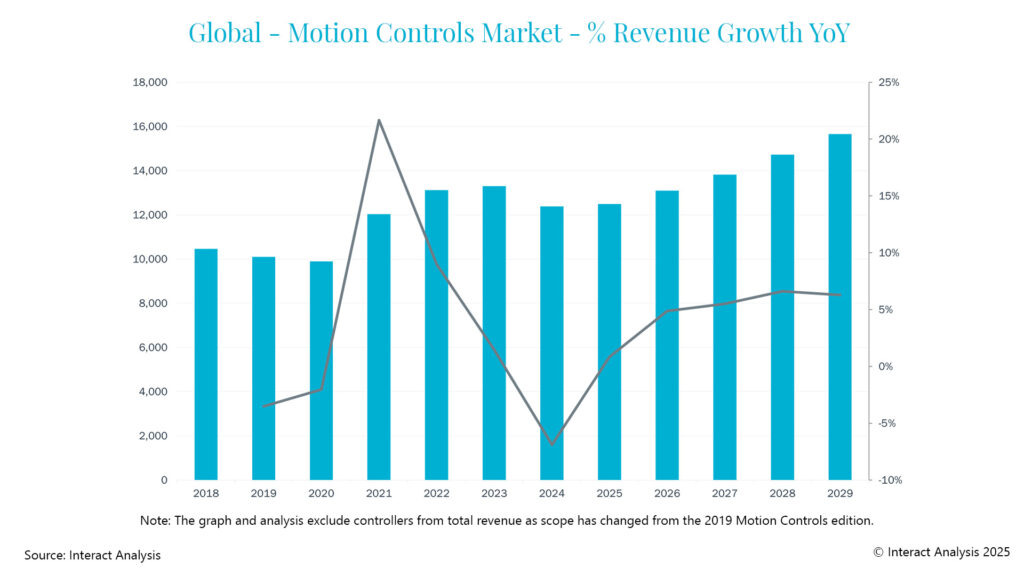

Posting revenues of $12.3 billion during 2024, this loss follows a period of unprecedented growth. While this decline has had a negative impact on the market, the long-term compound annual growth rate (CAGR) has remained largely the same at 3.5%, indicating a rebalancing of the market rather than something worse. Marked by low manufacturing output and a significant ‘destocking’ event, 2024 was a rough year for motion control vendors. However, for the reasons discussed in this insight, we believe the market is beginning to stabilize.

Our pre-pandemic forecast and the ripple effect of Covid-19

In 2019, amid a weakening manufacturing environment, the motion controls market saw a decline in revenue of -4%. During this period, Interact Analysis’ forecast for the motion control market through to 2023 was a CAGR of 3.47%. When this forecast was produced, we were not considering the possibility of a global pandemic. Therefore, this pre-pandemic CAGR is a good representation of market growth under ‘normal’ conditions.

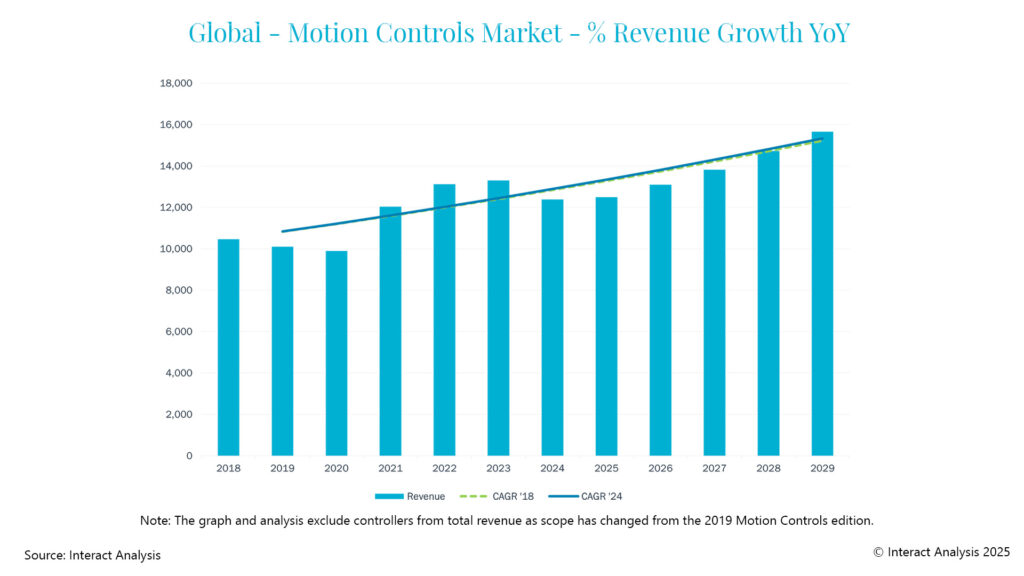

Following the economic shutdown in 2020, manufacturing industry growth returned in a big way. As shown by the graph below, the motion controls market grew by nearly 22% year-on-year in 2021.

2021 was a notable departure from previous predictions. This growth was unprecedented; demand was at an all-time high, and motion control suppliers couldn’t produce products fast enough. Customers of motion control suppliers were eager to order but struggled to obtain products due to well-publicized supply shortages. As a result, panic buying ensued and customers over-ordered motion control products throughout 2021 and 2022.

Fallout from over ordering = Destocking

After two strong years in 2021 and 2022, the market began showing signs that this unprecedented growth would have a broader ripple effect. As manufacturing production dipped in 2023, we began to see the reciprocal effect of over ordering in the previous two years. Backlog orders were worked through during 2023 and it became clear that new orders for motion control products were on a downward trajectory. Customers’ inventories of motion control components were full and manufacturing demand was down causing an inventory issue. This led to a decoupling of manufacturing output growth and motion control market growth as an additional force was leading to further market declines for the latter: destocking.

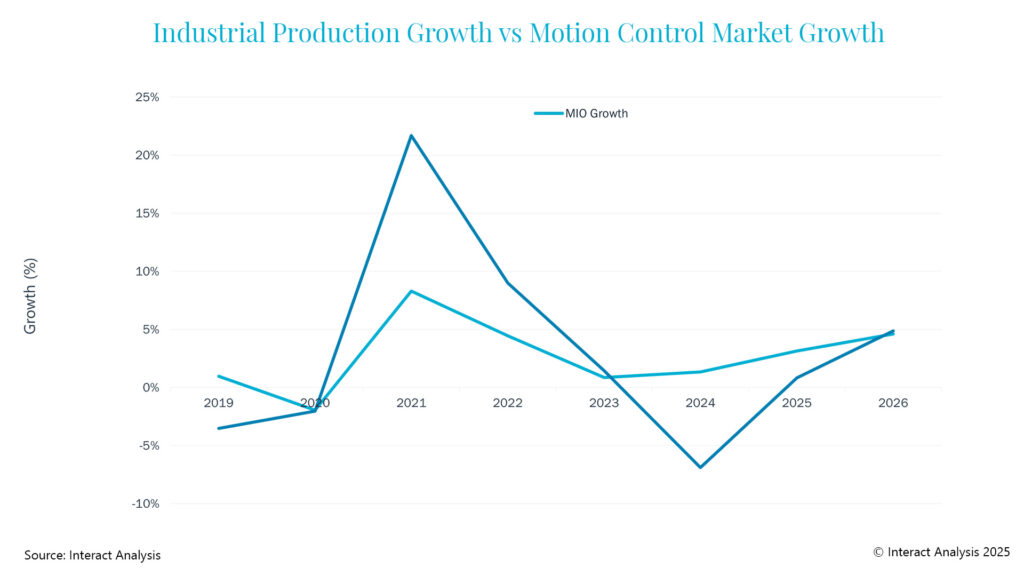

When we compare overall manufacturing output growth with the performance of the motion control market, we see this decoupling of the two series begin to take shape.

Prior to Covid-19, motion controls market growth closely correlated to the growth of manufacturing output. As we see in the above graph, the motion controls market became decoupled from manufacturing production from 2021, when over-ordering began.

Late 2023 represented the intersection of manufacturing production growth and motion control market growth. This intersection symbolizes the start of the ‘destocking’ effect and demonstrated the flipside to the unprecedented gains in 2021 and 2022. In 2023, the motion control market grew by just 1% and it became clear that amid low manufacturing production, motion control customers were overstocked with products and needed to wind down their inventories before placing new orders. This environment set the stage for motion control vendors to experience a significant decline in revenue during 2024.

Long-term expectations remain consistent despite short-term volatility

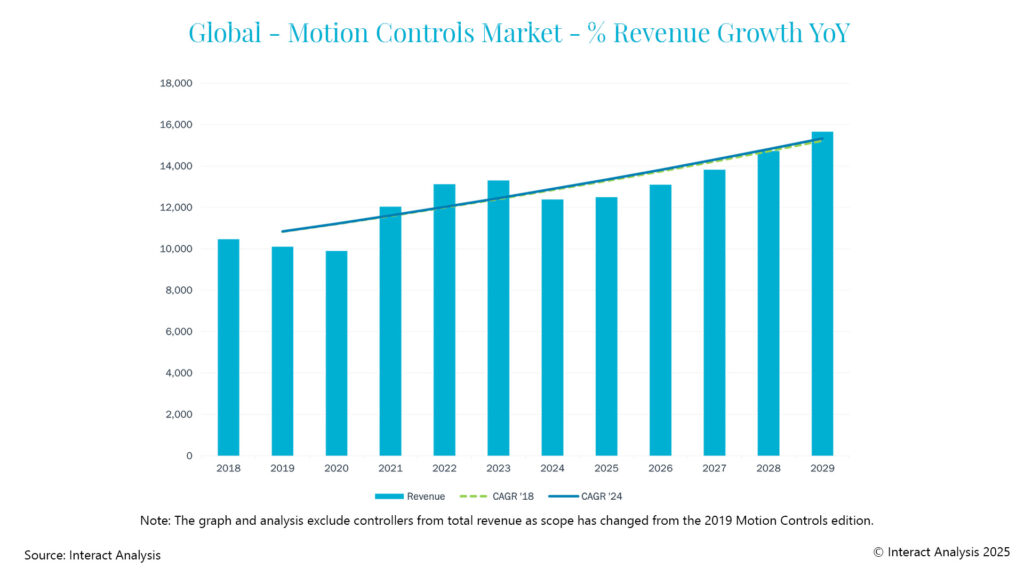

In the 2018 edition of our Motion Controls report, a CAGR of 3.5% was forecast for 2019-2023. Currently, despite the sharp gains and losses the market experienced between 2020 and 2024, the market is still following the same long-term trajectory. When we layer our new forecast with our historic data, the long term CAGR for the period 2019-2029 is also 3.5%, which is basically the same as the pre-pandemic forecast.

The graph above demonstrates the long-term linear trajectory, and the consistent path the market has been on despite short term volatility. This consistency demonstrates that the period 2021 to 2024 represented unique circumstances and not a new norm for levels of growth and decline.

As we look to 2025 and beyond, we are likely to see manufacturing production and motion control market growth begin to synchronize once again, indicating market stability. 2025 is likely to be mixed in terms of regional performance, with Europe continuing to face challenges deep into the year. However, we expect every region to begin to mount a recovery as destocking ends and new order growth resumes.

Final thoughts

Following the high growth years in 2021 and 2022, it is easy to lose sight of what ‘normal’ growth looks like in this market. While double-digit declines in some regions are alarming, they should be viewed in the historical context of the market as a correction. As destocking in the market eases, we expect a sense of normalcy to return marked by more modest and consistent growth rates. 2025 marks the first year climbing out of the market trough, and while it will be a slow process, the prognosis for the market in 2026 and beyond is much brighter.

For more information on our Motion Controls report, visit our webpage