By Samantha Mou, Research Analyst, Interact Analysis

As a Research Analyst based in China, Samantha provides support in the Industrial Automation sector. Samantha brings with her a master’s degree in economics, and has experience, whilst working in Germany, conducting market research in Industrial Equipment and Automobile Components.

The global geared motors and industrial gears (geared products) market was expected to generate $14.2bn in revenues in 2023, a slight decrease of 0.7% from 2022. However, over the next five years we anticipate the market will resume a steady growth trajectory following a further dip in 2024.

Geared products are widely used across various industries, with the conveyors sector being the largest among them and forecasting promising growth. Over the next five years, we expect sales to both the unit conveyors and bulk conveyors sectors to register a higher-than-average CAGR.

The geared products market is consolidating, with leading suppliers gaining market share, but there are also fast-growing challengers within specific regional markets or product types.

Contractions are expected in 2023 and 2024

Sales revenue of geared products is projected to increase again following a dip in 2024

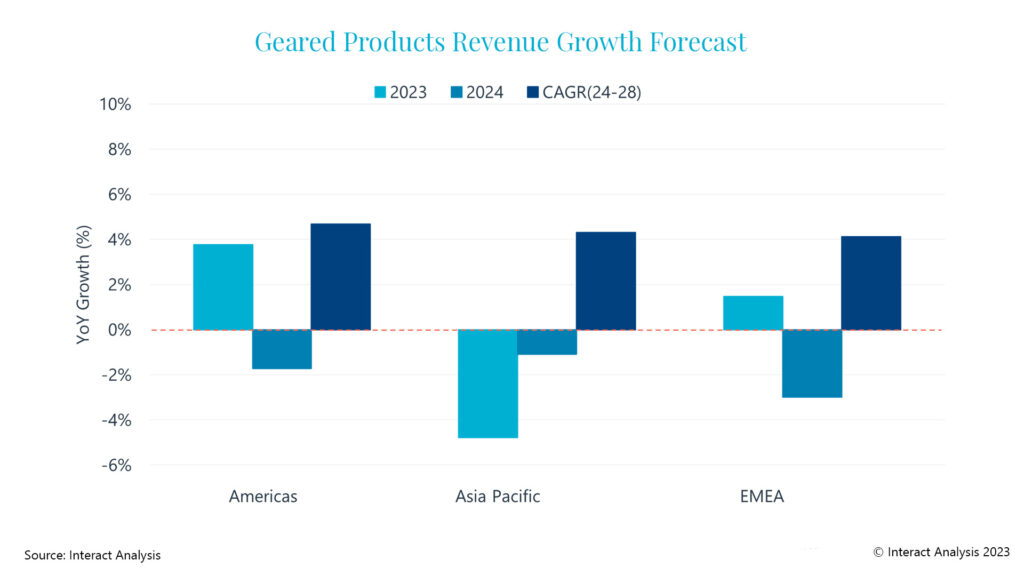

In 2023, the Asia Pacific market for geared products was expected to see a contraction in sales revenue of 4.8%, while the Americas and EMEA markets were projected to achieve reasonable growth of 3.8% and 1.5% respectively.

The decline in APAC market revenues in 2023 was largely due to the contraction observed in the China market. The continued property slump in China had a significant impact on the steel and aggregates sectors, and the post-Covid boom in li-ion battery manufacturing facilities has been cooling down. In 2024, the decline is expected to narrow given indications that China’s economy bottomed out in 2023.

The Indian and Indonesian markets have been driving growth of the APAC geared products market in 2023, but we anticipate these markets will contract slightly in 2024 due to the global economic downcycle.

Meanwhile, sales of geared products in the Americas market remained resilient in 2023 due to demand from mining and steel sectors in the US. However, contraction in new orders has already been observed in the market, indicating the start of an anticipated recession heralded by the sustained US Treasury yield curve inversion since mid-2022.

The growth seen in the EMEA market in 2023 reflects strong demand from the automotive industry. With the exception of the automotive sector, most application industries for geared products were expected to see average or weak growth this year. Due to anticipated weak global demand, our outlook for Europe’s machinery production is negative for 2024.

The conveyors sector will continue to drive growth for geared products

2024 is projected to be a down year for global geared products revenues, however, we anticipate the market to resume steady growth of around 3%-5% per year from 2025.

The outlook for future growth is supported by rising demand for general industrial automation and machinery, while the material handling sector is forecast to drive demand for geared products as a result of continued labour shortages and the positive mid- to long-term outlook for the warehouse and logistics sector.

In 2022, 29% of the market comprised sales in the conveyors, cranes, and hoists & winches sectors, which generated revenue of $4.1bn. From 2023 to 2028, the increase in revenue in these three material handling equipment sectors will account for 34% of overall revenue growth in the geared products market.

The unit conveyors and bulk conveyors market

In the latest edition of our report, we included further breakdown of the sector into unit and bulk conveyors. The market for unit conveyors will primarily benefit from investment in the warehouse, logistics, e-commerce and airport sectors; while the bulk conveyors sector is largely supported by the mining and construction industries.

Due to different application industries, the growth prospects of these two segments vary. For example, in the US market, forecast growth for sales of geared products in the unit conveyors sector in 2023 is much lower than that in the bulk conveyor sector, owing to weak demand from warehouses and strong demand from the mining industry. In contrast, demand from the bulk conveyors sector within the Chinese market is anticipated to shrink more because of the housing market downturn.

Overall, demand from the warehouse and logistics sector is anticipated to increase more than from the heavy-duty industries during the next five years. Our CAGR forecasts for geared products revenues in the unit and bulk conveyor sectors from 2023 to 2028 are 4.1% and 3.6% respectively.

Market consolidates, but challengers are growing in specialized segments

Continued growth forecast for market share of the top 10 vendors

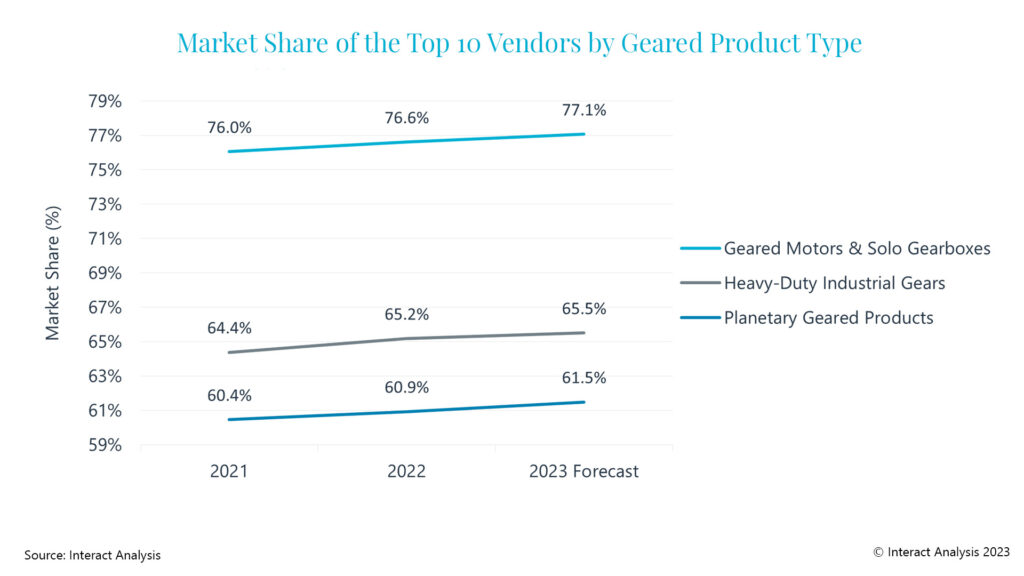

During 2023, consolidation of the vendor base continued. In 2022, the top ten suppliers accounted for 62% of global geared products market revenue, up from 60% in 2021. This number is expected to increase further in 2023.

We observed an increase in the top ten suppliers’ market shares for all three product segments. Among them, geared motors and solo gearboxes have the highest market share concentration, with SEW and Nord seeing a continued increase in their market share.

That said, ‘newcomers’ are expanding rapidly, penetrating markets for specific regions or product types. For example, WEG has been growing fast in the Americas geared motors market, and some Chinese vendors have seen good growth in their business in the EMEA market, particularly with worm geared products.

In the future, we expect the supplier base for geared products to continue consolidating gradually. However, alongside this, we may see medium and small suppliers growing rapidly within their specialized markets, particularly in emerging regional markets and in the wake of the current downcycle.

To learn more about our Geared Motors & Industrial Gears – 2023 report

Get in touch with Samantha Mou directly: [email protected]