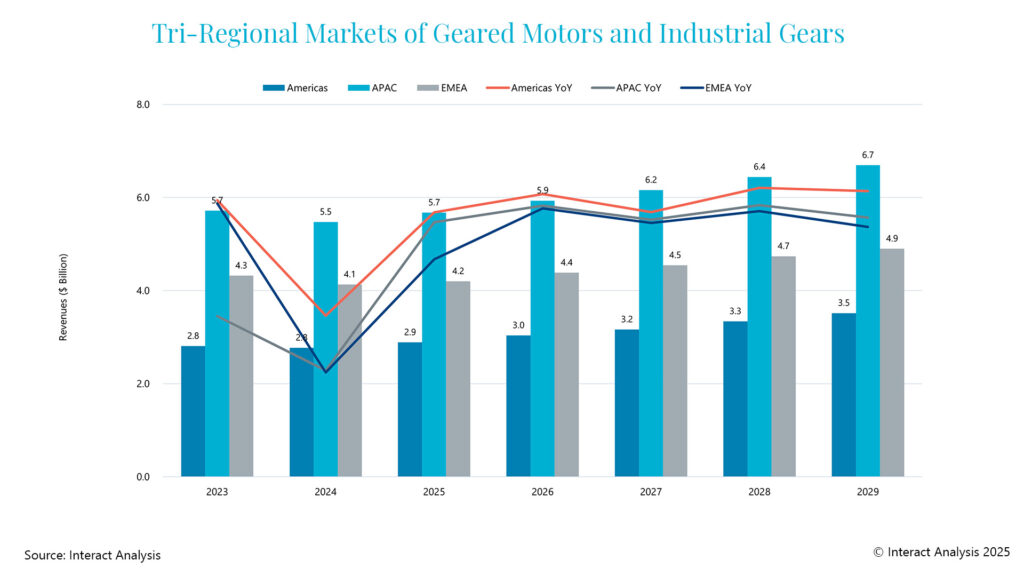

• Global revenues from geared products contracted by 3.7% in 2024

• Decline driven by sluggish demand in APAC and over-stocking in EMEA and the Americas

• Growth rates revised downwards for 2025 and 2026, but growth expected out to 2029

London, 24th March 2025 – After 1.9% growth in 2023, the global geared products market contracted by 3.7% year-on-year to $12.4 billion in 2024. The contraction of the market was caused by sluggish demand in the APAC region, as well as continued challenges caused by previous over-stocking in the EMEA and Americas regions.

However, the global geared products market is expected to show signs of recovery in 2025 and return to slow growth over the next couple of years. And the long-term forecast to 2029 is looking much more positive.

Growth projections from 2023 to 2029 for geared products looks positive over the long term

Sluggish demand in APAC and over-stocking problems continue in EMEA

The Asia Pacific market for geared products performed most weakly among the tri-regions in 2024. Sales dropped by 4.3% compared with the previous year. This decline was due to sluggish demand in the Chinese and South Korean markets, marking a second year of decline that was heavily influenced by China’s stagnant market.

At the same time, average prices dropped after rising from 2021 to 2023, driven by lower raw material costs and increased competition. This price pressure was felt strongly in the APAC region, where vendors were forced to cut prices to stay competitive.

Sales of geared products in the EMEA region fell by 4.4% in 2024, primarily because of de-stocking in the machinery sector. The machinery production sector faced weak demand and high interest rates, which then slowed down investment in the sector. Motors and gearboxes were hit harder than other markets due to higher inventory. Similarly, the Americas’ geared products market was also affected by de-stocking, largely affecting material handling products.

Tim Dawson, Senior Research Director at Interact Analysis, says, “The global geared products market contracted by 3.7% in 2024, however the future looks positive. The APAC region is expected to recover from the last couple of years and grow at an average of 2.7% per year, reaching an estimated $6.7 billion by 2029, while the EMEA region is anticipated to have slower growth at 2.1% per year over the same period and the Americas is predicted to grow fastest at 3.8% per year over the five-year forecast period.”

About the report

A report outlining the performance, trends and developments of the market for geared motors and industrial (heavy duty) gears. The research includes detailed market size and forecast data by product type, torque, industry and country.

www.InteractAnalysis.com