According to market intelligence specialist, Interact Analysis.

In 2024, the slowdown in the construction of lithium-ion battery recycling projects caused a decline in global equipment sales. The drop in raw material prices that began in mid-2023, coupled with deceleration in battery factory expansions, has significantly slowed the pace of recycling capacity growth. Since the recycling equipment market is closely tied to the development of new recycling capacity, it has been negatively impacted. However, the medium to long-term outlook remains positive. There has been rising demand for Li-ion batteries, driven by the electric vehicle and energy storage markets, alongside a gradual implementation of supportive policies and regulations. This has stabilized the recycling project market, paving the way for sustained growth in battery recycling equipment sales.

APAC takes the global market lead

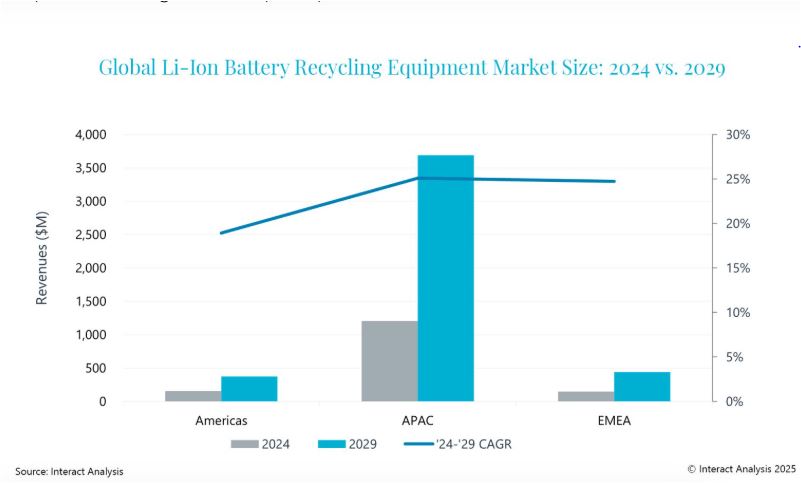

In 2024, the global lithium-ion battery recycling equipment market decreased from around $1.7 billion in 2023 to approximately $1.5 billion. We project that by 2029 the global market for lithium-ion battery recycling equipment will reach $4.5 billion, growing with a five-year compound annual growth rate (CAGR) of 24.5% from 2024 to 2029.

Strong annual growth is forecast for the Li-ion battery recycling market in the Americas, APAC and EMEA regions.

From a regional perspective, Asia-Pacific (APAC) is the largest market for battery recycling equipment, with sales accounting for approximately 80% of the global market in 2024. This is primarily due to the massive scale of China’s recycling capacity construction. The APAC battery recycling equipment market is expected to maintain a CAGR of 25.1% from 2024 to 2029, reaching approximately $3.69 billion by 2029. Europe, the Middle East and Africa (EMEA) is forecast a five-year CAGR of 24.7% over the same period, reaching a market size of approximately $440 million by 2029. Meanwhile, the Americas is projected a five-year CAGR of 18.9%, with the battery recycling equipment market expected to reach $380 million by 2029.

Market fragmentation and no dominant leader emerging

The Li-ion battery recycling process involves the use of a variety of equipment, including battery testing equipment, battery pack disassembly systems, and crushing and sorting equipment used in the pre-processing stage. This is in addition to the reactor, filtration system, MVR evaporation system, extraction system, crystallization system, and the drying machine used in the post-processing stage. Overall, the recycling equipment market remains relatively fragmented. Unlike the lithium battery manufacturing equipment market, which has seen the emergence of integrated market leaders, the recycling equipment market has yet to see a dominant player. The market landscape is still evolving, and its full potential remains to be realized.

From the perspective of companies, the inclusion of general-purpose equipment in the recycling process has opened doors for manufacturers that traditionally supplied equipment to the pharmaceutical and chemical industries, enabling them to enter the battery recycling market. For example, MVR evaporation system manufacturer AGT and manufacturer Jingjin Equipment (both based in China) have seen battery recycling become an important application for their equipment. In addition, some large battery recycling companies, such as Miracle Automation, have also begun to develop their own battery recycling equipment. Beyond standalone machines, some manufacturers are also offering integrated equipment solutions, particularly in the pre-processing stages. Other manufacturers provide an integrated solution that covers the entire process, from battery module disassembly to discharge and then to crushing and sorting.

As the world’s largest battery recycling market, China’s rapidly expanding new production capacity is driving higher demands for efficiency and safety in battery recycling. In the pre-processing stage, “flexible disassembly” is emerging as a key innovation, providing new momentum for the high-quality development of both the battery recycling and equipment markets. In the post-processing stage – to tackle issues such as high energy consumption and complex wastewater treatment (associated with the current mainstream hydrometallurgical technology) – some companies are adopting energy-saving methods, including low-temperature processes and waste heat recovery. Some are also exploring alternative technological routes like bio-metallurgical processes.

Looking ahead, the market may see the integration of different metallurgical techniques, leading to more efficient and environmentally friendly battery recycling solutions. As part of the growing trend towards automated, intelligent, and green battery recycling, companies with leading technology and the ability to integrate the industrial chain will be better positioned to navigate market changes and technological challenges. These companies are expected to gain a competitive edge and an advantageous position in the rapidly expanding market.

Market intelligence for the entire automation value chain | Interact Analysis