• The global machinery production output declined by -2.1% in 2024

• Machinery production expected to take a turn halfway through 2025, ending with year-on-year growth of 3%

• Trump tariffs, the decline of industrial giants and an AI arms race to cause uncertainty for manufacturing in 2025, although growth is projected overall

London, 17th February 2025 – Global machinery production (a sub-sector of manufacturing production) contracted by 2.1% during 2024, according to Interact Analysis. This pattern of decline is anticipated to continue into early 2025, but the market is expected to turn a corner by the halfway point of the year, with annual growth of 3% projected, the market intelligence specialist’s Manufacturing Industry Output (MIO) Tracker shows.

Looking at manufacturing production, the outlook for 2025 is more uncertain than in recent years. This is in part due to the Trump presidency in the US and the anticipated trade tariffs. In addition, the deterioration in performance of industrial giants in Europe and the AI arms race have the potential to cause sizeable fluctuations in growth across industries and regions. The global manufacturing industry has similar projected growth to the machinery sector, showing a significant dip in 2024 followed by steady growth in 2025 through to 2029.

Looking out to 2029: A mixed outlook for manufacturing in China, Europe, and the US

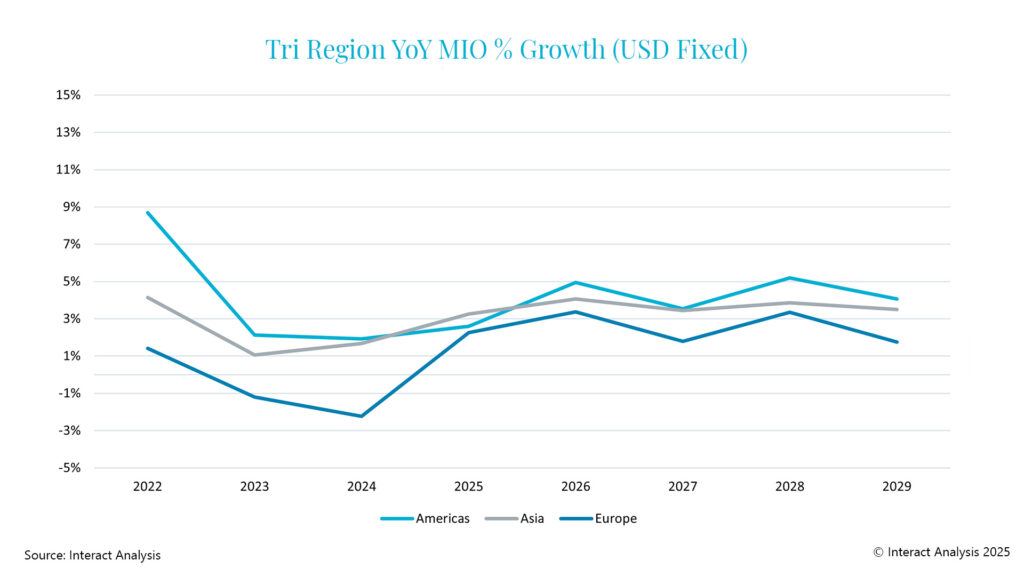

Growth is forecast from 2025 to 2029 for the global manufacturing sector in Europe, Asia, and the Americas regions

The growth forecast for the manufacturing industry is lower in many of the larger regions than it has been historically and Interact Analysis has reduced its long-term outlook for the sector across several key regions such as Germany and Japan; and having reviewed its predictions for emerging regions in Asia as too aggressive have consequently revised these down. Projections for Europe have also been lowered due to the current economic stagnation. On the other hand, the outlook for US production has become more positive due to the expected impact of the Trump Administration’s business-friendly policies.

China – While there was a global decline in 2024, China’s manufacturing industry recorded 1.2% growth. Although it is positive year-on-year, it marks a very weak year for China’s manufacturing industry compared with its historic growth. China faced major challenges throughout 2024, including weak domestic demand, excess production capacity, and intense price competition. Despite these challenges, the Chinese manufacturing economy started to improve in Q4 and, therefore, the forecast for 2025 has been increased. The recovery is expected to be gradual, but stronger growth is anticipated in 2026 and beyond, although factors such as low profit margins for Chinese manufacturers and a potential trade war could further intensify deflationary pressures.

Europe – As a whole, Europe is expected to struggle due to high energy costs, self-imposed environmental targets, and rising labour costs. Regions such as Germany and the UK are seeing minimal growth and are struggling to compete globally. De-industrialization is a major concern for Germany, as German automotive manufacturers announce plant closures and mass layoffs, significantly impacting the European manufacturing industry.

US – The US showed resilience in 2024, with growth of 2.7%. However, there are barriers that could hamper economic growth in the future, such as plans by the incoming Trump administration to impose wide-ranging tariffs and the likelihood of retaliation from regions with tariffs levied against them. In this scenario, industries which are reliant on components or non-US goods will see costs increase. Despite these concerns, there’s optimism for US manufacturing, as the Trump administration has made it clear that growing America’s economy is a top priority, with policy decisions expected to reflect this.

Commenting on the latest MIO report, Jack Loughney, Lead Analyst for the MIO Tracker at Interact Analysis said, “Machinery production had a difficult 2024 but the outlook for 2025 is much brighter. The sector shrank by -2.1% overall in 2024, but this is projected to be offset by more moderate growth of 3% in 2025. The malaise of 2024 will continue into the start of 2025, but we expect the sector will have turned the corner by the halfway point in the year.”

About the report

In a fast-moving sector with complex correlations, it is critical to understand the state of the market now, where it was, and where it will be. This report quantifies the total value of manufacturing production with deep granularity – for over 102 industries, across 45 countries, and presenting 18 years of historical data – for a complete business cycle, pre-recession to the present day.

We have carefully organized the country data around a common taxonomy to provide easy-to-interrogate, like-for-like comparisons. Credible five-year forecasts round out the view.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth.

To learn more, visit www.InteractAnalysis.com