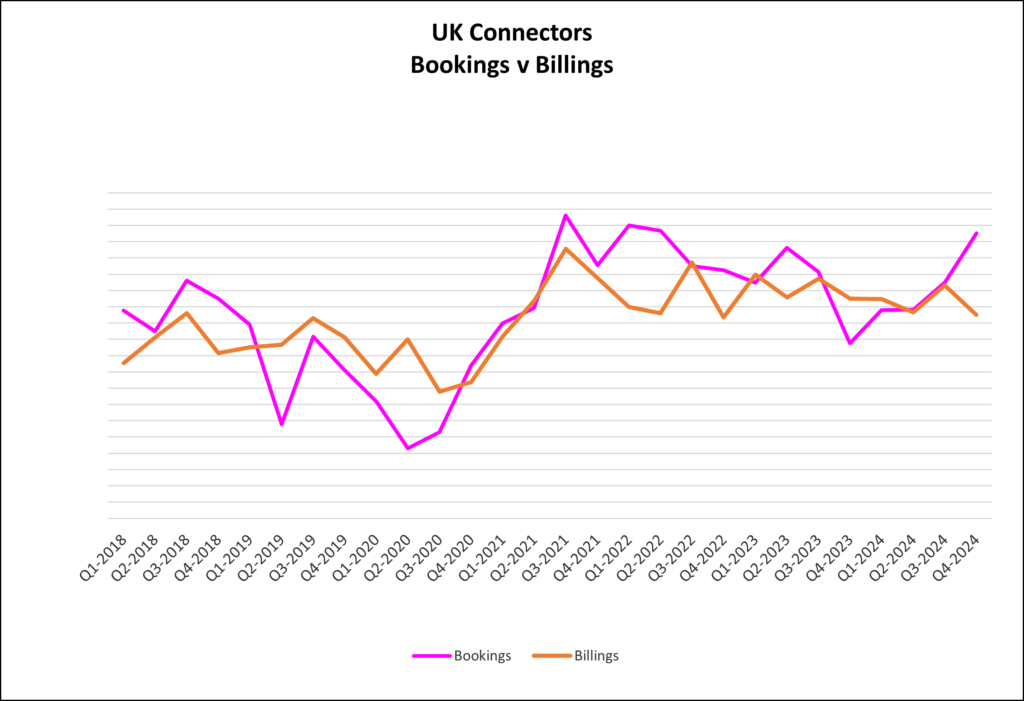

Orders were positive with BtoB at 1.05:1, due to the high order intake in Q4.

Headline performances: –

• Revenues down -4% yoy and orders up 2% yoy

• Order intake in Q4 of 2024 was the highest since Q2 of 2022

• B to B became positive at 1.05:1 due primarily to the high order intake in Q4

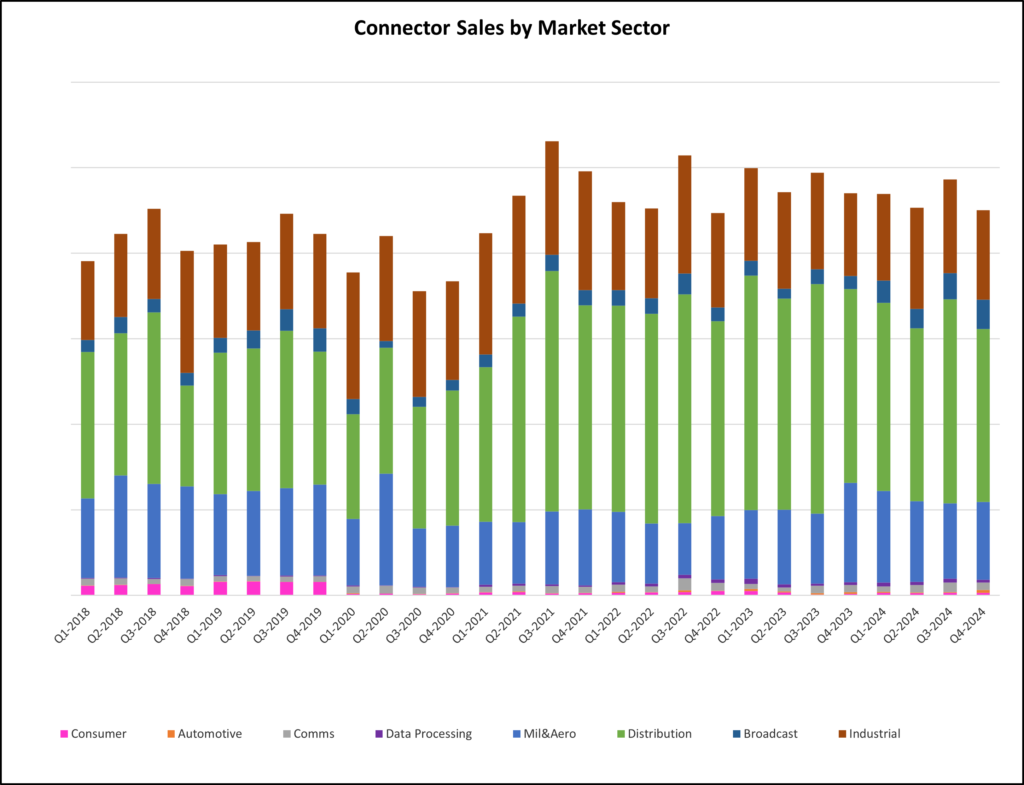

• Markets continue to perform variably.

• Markets: –

• Broadcast up 83%

• Mil/Aero 4% (this is a significant drop as it was up 16% at the end of Q3

• Medical 48%

• Communication 29%

• T&M down 17%

• Mass Transport down 13%

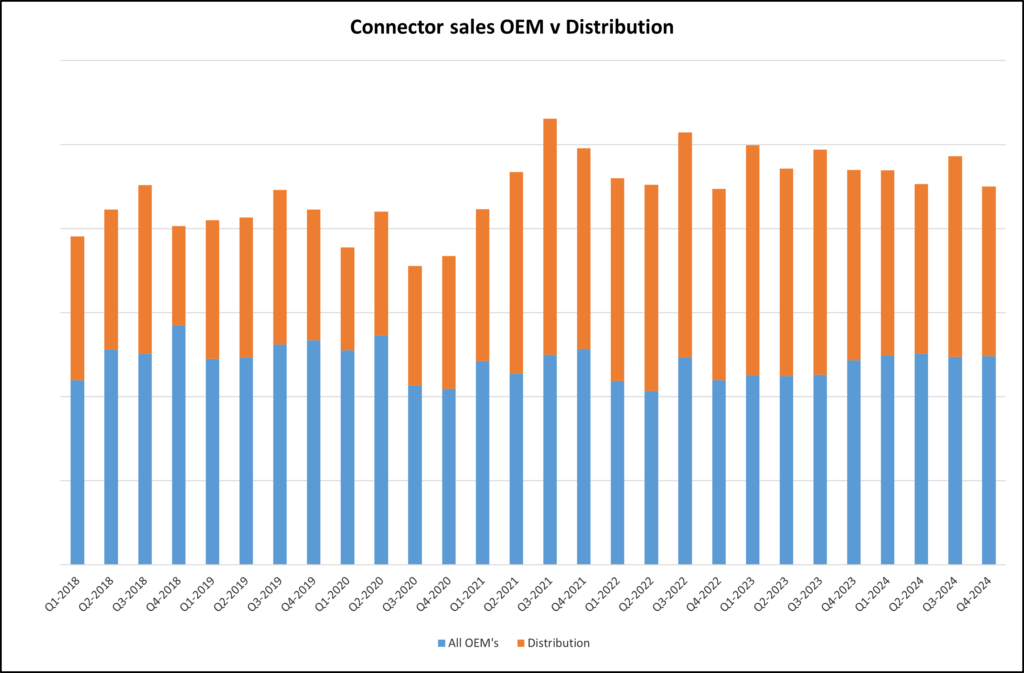

• Distribution continues to be weak as it is down 15%. This should be taken in context as Distribution represents 46% of our members sales.

Overall Members reported a reduction in YoY revenues of -4% but in some areas members experienced up to -30% depending on technology and markets, despite the low single-digit drop all members expressed concern about the markets in 2024 and all faced significant challenges.

It sems that distributors have been destocking, hence the poor distributor revenues of -15%, and it would appear that customers had held off placing orders until the budget, it would also appear that customers had decided to use the 4th quarter of 2024 to place the held orders hence the jump in member order intake.

The level of new RFP’s etc seems to be high and some key projects are rolling into 2025, but this is only masking our members concerns over the prospects in 2025.

Members are facing a huge number of challenges, such as customer bad debt issues are increasing, recruitment of key skills remains a critical challenge, the increase in employer NI costs, increase in the minimum wage and the change to employee rights all conspire to make some of our membership more pessimistic about 2024.

All these issues are impacting costs and members will be trying to get price increases where possible. Some members suggested that with the rise in NI costs some may have to offer reduced pay increases and freeze recruitment, this was obviously based on the scale of their UK operations, even improvements in productivity will only go part way to recovering the additional costs.

2025 is looking like a year of caution with most members expecting flat revenues and if any growth is achieved it will be extremely low single digit.

A lot of members have business elsewhere such as the US, which appears to be quite strong at the moment of writing, and Europe where it seems Germany and some other areas of Europe are really struggling.

S&P Global/CIPS UK Manufacturing PMI

UK manufacturing output, new orders and employment fall at faster rates in December PMI falls to 11-month low of 47.0 in December Job losses as rising cost pressures drive restructuring efforts Business optimism dips to two-year low as economic outlook weakens The downturn in the UK manufacturing sector deepened at the end of 2024, as December saw rates of contraction in output, new orders and employment gather pace. Destocking at clients, subdued market confidence and operational restructuring in response to forthcoming legislative changes hit output and demand and reinforced ongoing efforts to achieve cost efficiencies.

The seasonally adjusted S&P Global UK Manufacturing Purchasing Managers’ Index™ (PMI®) fell to an 11-month low of 47.0 in December, down from 48.0 in November and below the earlier flash estimate of 47.3. The PMI has remained below its neutral mark of 50.0 – signalling deterioration – in each of the past three months. Manufacturing production contracted for the second consecutive month in December, with the rate of decline accelerating to its fastest since January 2024.

Although output was scaled back at SMEs and large-scale producers alike, the downturn was noticeably deeper at SMEs (a similar picture was painted with regard to new work intakes). Lower production volumes mainly reflected subdued domestic market sentiment, customer destocking, efforts to prevent inventory building up at manufacturers’ own warehouses and the impact of weaker demand from European clients.

Total new business fell for the third straight month and at the quickest pace since October 2023. There was also some mention of some UK-based clients scaling back on purchasing in light of the higher cost environment, sometimes linked to restructuring operations in advance of forthcoming rises in labour costs and payroll taxes. The current downturn and manufacturers’ weakened outlook Rob Dobson, Director at S&P Global Market Intelligence “A stalling domestic economy, weak export sales and concerns about future cost increases led to the steepest contraction of UK manufacturing production for almost a year in December. “Manufacturers are facing an increasingly downbeat backdrop. Business sentiment is now at its lowest for two years, as the new Government’s rhetoric and announced policy changes dampen confidence and raise costs at UK factories and their clients alike. SMEs are being especially hard hit during the latest downturn. “This is sending a winter chill through the labour market. December saw the sharpest cuts to staffing levels since February. Some companies are acting now to restructure operations in advance of the rises in employer National Insurance and minimum wage levels in 2025.

The survey price gauges edged higher, reflecting rising transportation, labour, and material costs, in some cases due to supply chain stresses pushing up global market prices. With costs expected to rise again in early-2025 as the announced Budget changes come into actual effect, the Bank of England is likely to remain cautious about further interest rate cuts.

Optimism dipped to a two-year low, with sentiment declining across all three of the sub-sectors (consumer, intermediate and investment goods) and company size categories (small, medium, and large) monitored by the survey. Manufacturers reported concerns about a lack of market confidence, inflationary pressures, rising costs (especially for employer NI and payrolls) and expectations of weaker economic growth looking ahead. Manufacturing employment fell for the second month running, with the rate of job cutting hitting a ten-month high. Some firms noted that they were taking action in response to weak market conditions and that forthcoming increases in employers’ National Insurance and the NMW\NLW had encouraged cutbacks to working hours and longer-term efforts to restructure workforces. Cost caution also led to a reduced level of input purchasing and intentional depletion of inventories of both inputs and finished products. Purchase price inflation edged higher in December. Anecdotal evidence cited rising transport costs and raw material prices, as well as the pass through of higher employment costs by suppliers. There were also reports of rising global market prices, material shortages, taxes, and currency fluctuations. Current and expected future cost increases led manufacturers to pro-actively raise their selling prices. Supply-chain pressures continued to build, as the ongoing Red Sea crisis and disruptions to shipping and at ports led to an increased incidence of delivery delays.

Make UK report.

Britain’s manufacturers believe the introduction of an industrial strategy will help them increase investment, boost productivity, and secure the skills they need for the future, according to Make UK and PwC UK’s Executive Survey 2025.

This annual, flagship report carries the views of more than 150 senior executives on the opportunities, risks, and challenges for their business in the year ahead, as well as the outlook for the UK and international economies.

It finds that more than half of companies say they will increase investment in response to a long-term industrial strategy. While more than four in ten believe such a strategy will lead to increased productivity, with a similar number saying it will help them secure the skills they need for the future.

As well as the expected benefits from an industrial strategy, the Executive Survey 2025 reveals that, despite the current challenges from escalating costs and a potential trade war, the majority of manufacturers believe that the UK remains a competitive place to do business, with business opportunities in 2025 far outweighing current risks.

However, despite this view, just as many think the UK economy will deteriorate as grow in 2025. While over 9 in 10 manufacturers expect employment costs to rise, with around three quarters expecting other cost increases around business taxes, logistics and transport in particular.

Summary

At the exit of 2024 ITSA held a round table “state of the nation” meeting to get the views of its members on the impact of the governments budget plus other global issues facing the UK connector market.

It is obvious that 2024 was a challenge, particularly in the last quarter but, has as been seen historically, the UK connector market held up well.

Members reported continuing variations in market performances, which has made it exceedingly difficult to plan and forecast for investments etc.

Following the government budget in the last quarter all members had to relook at how they saw 2025 developing and although there are some positive market signs, the extra cost burdens they are facing with the NI increase and minimum wage uplift, together with increases in material costs, has meant that recruitment in particular and planned salary increases are all being scaled back.

ITSA members have bucked the trend in the past and we can only hope this is the case in 2025.