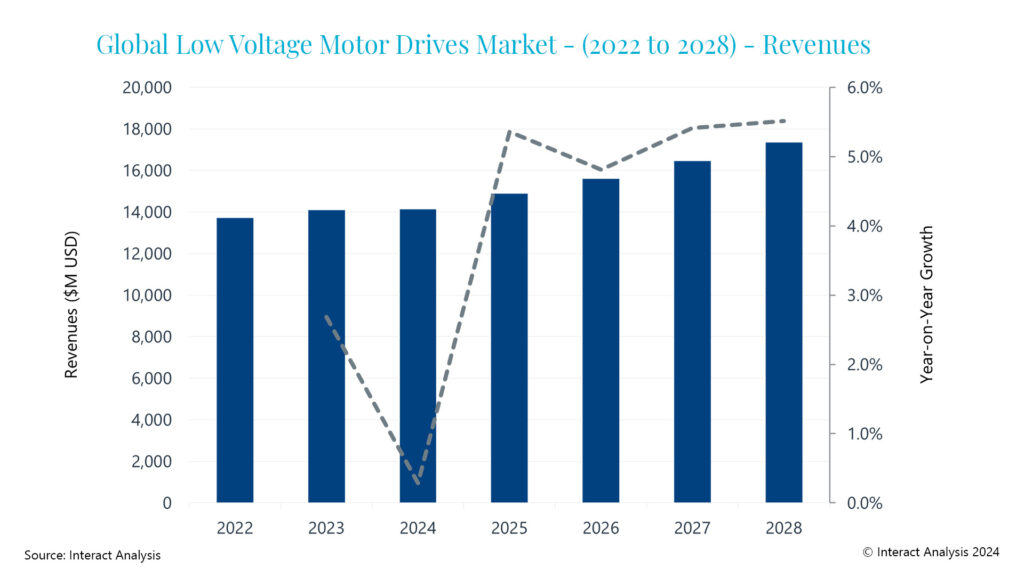

- Market to expand at a CAGR of 4% through to 2028

- Pace of growth slows in 2023 and 2024, with steady growth returning in 2025

- Volatility affecting prices eases in 2023, leading to contraction

London, 6th February 2024 – The low voltage (LV) AC drive market saw unit shipments surpass 20 million in 2023 as the market continues to expand, new data from Interact Analysis shows. According to the market intelligence specialist, the pace of growth slowed last year and is expected to continue to do so in 2024, with steady growth returning to the global drives market in 2025. A CAGR of 4% is predicted through the forecast period to 2028, in line with expectations for the manufacturing economy as a whole.

Revenues in the LV AC drive market reached more than $14 billion in 2023, but strong backlogs fueled growth during the first half of 2023 and drives vendors reported these had fallen substantially in the second half of the year. Following several years of higher average sale prices and unprecedented demand, a shift was evident in a slowdown in the market, which recorded growth of just 2.7% for 2023.

Revenues in the LV AC drives market reached $14 billion in 2023.

The trend is forecast to continue into 2024, with softer demand and downward price pressure pushing markets into a period of contraction and a global revenue growth rate of 0.3% predicted. This applies to every tri-region except for Asia-Pacific (APAC), where Chinese manufacturing economy growth is expected to outstrip many other major regions – China is anticipated to account for 28% of total drive market revenues in 2024.

Volatility in the market during 2021 and 2022 has largely subsided, affecting price performance. Global average selling price contracted by -0.3% in 2023, driven by price falls in APAC.

Brianna Jackson, Research Analyst at Interact Analysis, explains, “The inflated price levels of many commodities, which led to an increase in selling price for drives in 2021 and 2022, have fallen substantially from their peaks in 2022. This has resulted in pressure from customers to decrease prices and we expect prices to erode further in 2024, shrinking by an estimated -1.5% during the year.”