by Interact Analysis, Research Analyst at global market intelligence firm, Interact Analysis.

The market for machine-integrated robots is gaining momentum, with steady growth forecast for the market over the coming years, despite sluggish overall growth in the industrial automation market. Partnerships are increasingly being announced between robot vendors and automation providers to develop new products and solutions.

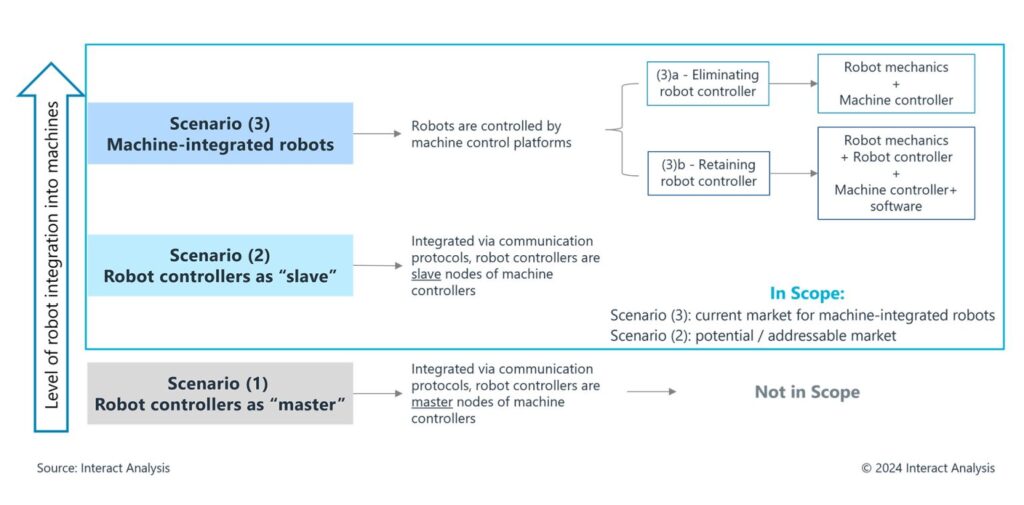

In our latest research, ‘machine-integrated robots’ are defined as robots controlled by machine controllers. The concept emerged as part of efforts to unify control of machines and robots, primarily by eliminating dedicated robot controllers. However, there is also the option of retaining robot controllers and programming the robots directly using machine controllers through software platforms.

The graphic below illustrates the scenarios covered by our latest report, Components in Machine-Integrated Robots:

We have identified 3 main scenarios of Machine-Robot Integration

Shipments of machine-integrated robots are expected to grow steadily by 9.2% in 2024 despite sluggish growth overall in the industrial automation market. Over the next five years, we expect the market to experience accelerated growth even as the standard industrial robot market matures, with a forecast compound annual growth rate (CAGR) of 15.7% from 2024 to 2029. North America and Europe are expected to lead the market growth.

We see this growth potential primarily driven by the ongoing shortage of robot programmers and engineers, as dedicated robot programming languages are no longer required for machine-integrated robots. In addition, as machine builders, automation solution providers and robot manufacturers continue to cooperate in this segment, the number of integrated solutions available on the market is increasing, and this will also accelerate the market growth of machine-integrated robots.

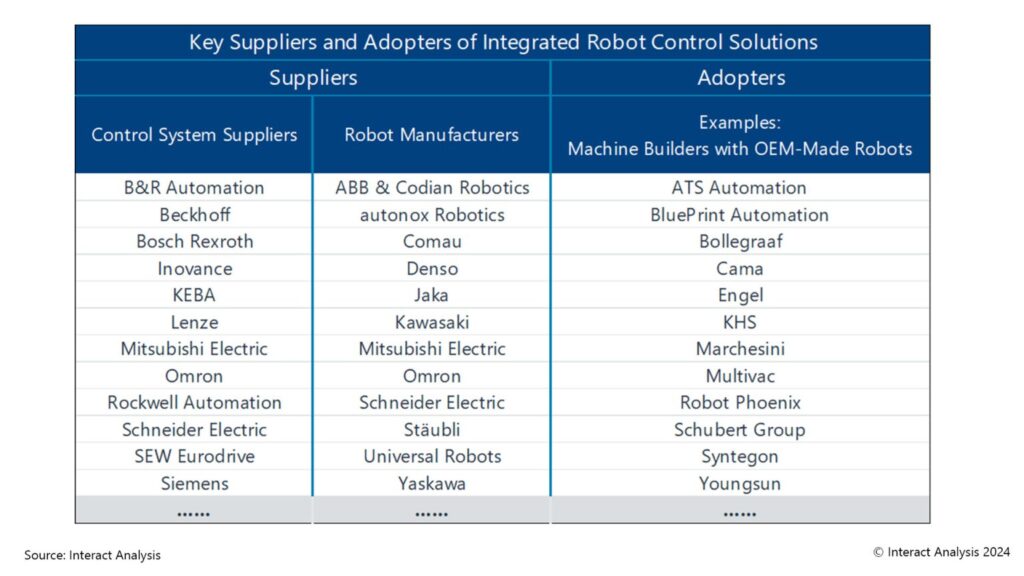

To address the growing demand, both robot vendors and machine OEMs are manufacturing mechanics for machine-integrated robots. For each type of robot (articulated, cartesian, collaborative, delta and SCARA), there are machine builders making the mechanics in-house (OEM-made robots) in order to develop their robotic machines, and many of them even build customized kinematics. In the meantime, robot vendors are offering models that support machine-integrated robot control. Manufacturers of industrial automation and motion control products are the most active participants in this emerging market, cooperating with robot vendors to promote integrated robot control solutions to machine OEMs as well as system integrators.

Many motion control product vendors, robot manufacturers and machine builders have launched machine-integrated robot solutions

Robot manufacturers and automation vendors partner for machine-integrated robots

Over the past five years, collaboration between automation solution providers and robot manufacturers in this area has accelerated. In April 2024, Siemens announced its cooperation with Universal Robots and Jaka. Collaborative robots from both vendors now support the Standard Robot Command Interface (SRCI), enabling robot programming via Siemens PLCs.

In 2023, Rockwell signed a Memorandum of Understanding with Korean collaborative robot vendor Doosan Robotics. Doosan Robotics is reported to be working on integrating its robot control into Rockwell’s Logix system. If the two companies cooperate in this area, Doosan Robotics may allow integrated control of its collaborative robots without using dedicated robot controllers.

In 2022, Beckhoff launched the modular industrial robot system ATRO, targeting machine builders and integrators to enable them to build modular robots integrated into Beckhoff’s control platform. The company has been active in building an ecosystem for integrated control of machines, robotics, vision, safety and other functions.

In addition to the above, in recent years many industrial automation manufacturers have launched solutions for machine-integrated robots. For example, Omron released machine controllers designed for integrating robots, and SEW Eurodrive and Lenze both introduced specialized solution kits for OEM-made delta robots. This year, Schneider Electric launched new collaborative robot models powered by motion controllers that unify PLC, motion and robotic control functions, extending its machine-integrated robot solutions from industrial robots to collaborative robots.

Final thoughts

Participants all have their own motivations for joining the machine-integrated robot market. Automation solution providers are targeting this market to expand sales in the robotics area. As it is not easy to enter the component market for standard industrial robots, the market for machine-integrated robots has brought new opportunities for robot component suppliers. For robot vendors, they see opportunities to enlarge their customer base and increase supply to industries that cannot be accessed by robots with dedicated controllers. Where machine builders are concerned, in addition to the advantage of saving engineering time brought by integrated solutions, some of them would like to build special robot kinematics in-house to address customized demands and create more unique selling points (USP) for their machines, and it is more practical to integrate these OEM-made robots with machines using machine controllers.

Data on the machine-integrated robot market is available in our new report, Components in Machine-Integrated Robots 2024, published in July 2024. The report on machine-integrated robots analyzes 6 robot types used across 8 application industries in 3 major regions, and the key components in these robots, including servo motors and drives, precision gearboxes, controllers, sensors, end effectors, machine vision systems and other components.

For more information on this report and the global machine-integrated robot market please contact [email protected]