When analysing machinery market performance, two key factors have driven the short-term forecasts in our Manufacturing Industry Output (MIO) Tracker. Not only has machinery production been hit with high interest rates in recent years, but we have also seen a build-up of high inventory levels as a direct result. Across 2024 and 2025, the resultant period of destocking has caused machinery production to stall in what otherwise could have been a more positive 12 months for growth. However, the picture is not consistent across all machinery industry sectors, with particularly strong performance expected this year in sectors such as packaging machinery, mining & quarrying, and semiconductor & electronics machinery production; driven by technological advancements, energy transition and macroeconomic factors.

How are US tariffs impacting machinery markets in Asia?

Despite a stronger-than-expected start to the year for regions such as Japan, we still expect tariffs to have some negative impact on the Asian market. South Korea saw a drop in machinery investment early on in 2025, including in semiconductor machinery, but this appears to be a temporary decline, as capital goods imports are on the up and machinery orders have increased. When it comes to China, the majority of machinery is consumed domestically so the tariffs are unlikely to have much of an impact.

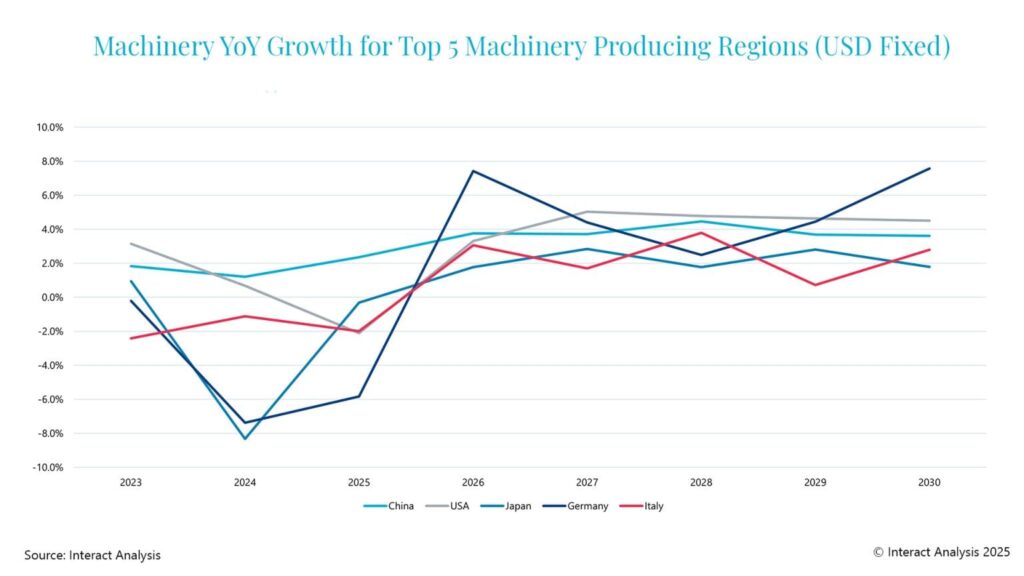

The 5 major regions are expected to see machinery growth in 2025, despite tariffs

What is the current packaging machinery outlook for 2025?

In general terms, factory expansions in India, Vietnam and Mexico are expected to drive growth in the global packaging machinery sector, along with a potential increase in near-shoring to the US. Three key factors contributing to packaging machinery industry growth are technological advancements (such as AI integration, IoT and predictive maintenance), sustainability, and cost pressures. There is rising demand for new, integration-ready machines that handle rapid changeovers and varied SKUs, while companies are also keen to invest in more sustainable machinery, particularly in Europe due to the EU Packaging and Packaging Waste Regulation (PPWR). Similarly, in the US, the FDA is increasingly focused on tamper-evident features for food and pharmaceutical goods.

What is the current semiconductor and electronics machinery outlook for 2025?

We are also seeing three key drivers in the semiconductor industry, namely increasing use of AI, 5G, and demand from electric vehicles. Some of the largest semiconductor equipment manufacturers – including ASML, Applied Materials, and Tokyo Electron – are undertaking massive capacity expansions. There are currently 18 new semiconductor fabrication projects gearing up for machinery orders, including those in the US, China, Japan, Taiwan, and Europe. Meanwhile, some territories are pushing for a rapid expansion of semiconductor production because governments see it as a national security issue and are incentivizing the reshoring of semiconductor production capabilities. Our MIO Tracker shows the dominance of Asian countries, in particular China (23%), Japan (20%), and South Korea (13%), in semiconductor production.

What is the current mining and quarrying machinery outlook for 2025?

A surge in the use of electric vehicles, wind turbines, and battery storage is causing a boom when it comes to critical minerals mining and has had a positive impact on the tunnelling and extraction equipment markets. We are seeing an increased demand for mining and quarrying machinery in regions such as Australia and Canada, which are rich in critical minerals needed for energy transition – copper, cobalt, and lithium.

China currently dominates the production of rare earth minerals and also produces more than 40% of the world’s mining machinery. The US is moving to protect itself by granting FAST-41 status to 10 US mining projects to boost domestic mineral production. This should, in turn, reduce America’s reliance on foreign sources, create new jobs, and support economic growth. However, steel and aluminium tariffs are likely to drive up the cost of production of machinery in the US.

What is the current machine tools outlook?

There are short-term concerns for the machine tools sector, but a better long-term outlook. The current industry climate for machine tools and the US tariffs have forced some companies in North America to reduce production due to a drop in domestic and international demand, but the long-term impact of tariffs on the US market could be beneficial if more metals and automotive production does indeed take place in the US. Meanwhile, China is consolidating its position as the largest machine tools producer in the world by volume, while India is also emerging as a key player. We expect the market for machine tools to shrink slightly in 2025. Prospects are relatively low currently as there are so many fundamental issues for the sector – such as the phasing out of ICE engines – which need to be addressed. If they can be dealt with then things could improve. An unexpected advantage to consider is whether the increase in remilitarization in Europe will lead to more European weapons and vehicles procurement from within the bloc. And, if so, we could see demand for machine tools increase commensurately.

What is the current outlook for textile machinery?

China remains the largest producer of textile machinery, accounting for 60% of global production, but we are seeing a movement of apparel production to India, Vietnam and Bangladesh, which is driving textile machinery demand in places like Turkey and India itself. In 2015, India accounted for 4% of textile machinery production with a MIO production value of under $2 billion, rising to a projected 8% of total production and a MIO production value of $4 billion by 2025. Over the same period, this increase will see India jump from fifth in the world to second place.

Final thoughts

Tariffs in the United States have resulted in a downturn in new machine orders, with owners worried about constant changes in charges and U-turns. It is expected, just as we saw with the 201 tariffs in 2018, that new orders may continue to rise until the tariff enforcement date of July 10th. At this point, orders are expected to drop significantly, which will have a knock-on effect on production as a whole. Europe continues to struggle, with January and February showing exceedingly poor numbers in certain sectors. For example, German agriculture, mining, and textile machinery all declined by at least 10% year-on-year, with Italy and France also suffering a similar fate.

However, as the analysis above indicate, the picture is not consistent across all regions and machinery sectors. Industry in China as a whole looks set to start recovery in 2025, with this strengthening into 2026, which will benefit the country’s machinery sector, while semiconductors, mining & quarrying, and packaging are seeing stronger growth caused by a wide range of sector-specific factors. And we have yet to see what the final US trade tariffs will be to fully analyse their potential impact on the market. Suffice to say, the outlook for the machinery manufacturing market in 2025 is mixed.