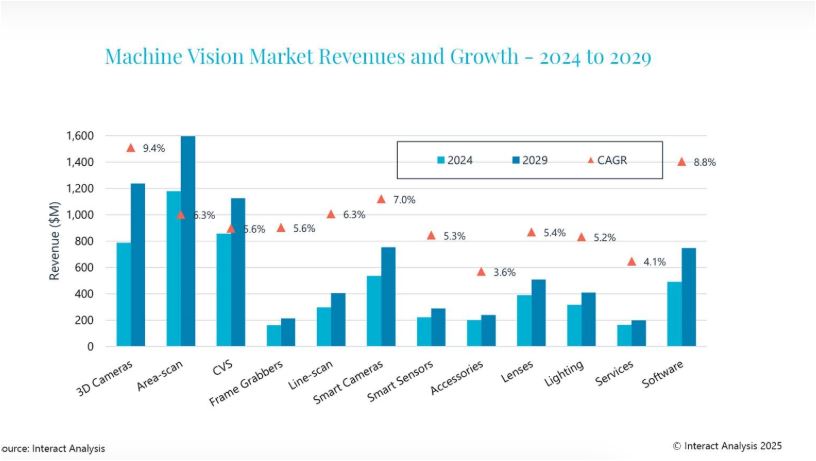

The global Machine Vision market generated revenue of $5.6 billion in 2024, down 3.9% from 2023. However, growth is expected to pick up from 2025 and, in the 2nd edition of the Interact Analysis report into the global machine vision market, we predict a compound annual growth rate (CAGR) of 6.6% over the next five years, starting with a small increase of 1.5% in 2025. We anticipate the highest growth rates will be seen in the software and 3D camera markets, where we forecast a CAGR of 8.8% for software and 9.4% for 3D cameras. Software revenue is predicted to rise from $490 million in 2024 to almost $750 million in 2029, while 3D camera revenue is set to climb from $787 million in 2024 to more than $1.2 billion in 2029.

Particularly strong growth is expected in the global machine vision software and 3D camera markets

Rapid AI software growth to benefit overall machine vision software market

We define machine vision software as the following: specialized computer programs and algorithms designed to process and analyze visual information captured by imaging devices, such as cameras, in machine vision systems. These software applications play a crucial role in interpreting images, extracting relevant information, and making decisions based on visual data. Software is predominantly concentrated on image libraries that are rule-based and tell the system what to do with certain outcomes from the image captured. However, the market for AI-based/deep-learning software is now beginning to grow, as it enables the system to learn further and have more outputs for evaluation. Software development kits (SDKs) for machine vision would also be considered within the vision software definition, although they are generally provided free of charge with the hardware so any revenue contribution to the software market from SDKs is negligible.

Software has traditionally used software libraries predefined to conduct machine vision tasks. There are many suppliers that offer software libraries and typically customers pay for a license. Integrators and distributors generally purchase multiple software libraries and use them when implementing vision systems for end customers. The emergence of AI and its use in software for machine vision has enabled new customers to venture into automation using machine vision for the first time, as well as allowing existing customers to automate additional workflows and tasks they were previously unable to due to system limitations. Furthermore, AI software not only allows for easier implementation and programming of vision applications – bringing the vision opportunity to new customers; but it can also work in more challenging environments where factors such as poor lighting or challenging product orientation have formerly been an issue.

We expect AI software to grow at a much faster pace than that of traditional software libraries, and this in turn to promote stronger growth within the machine vision market overall.

AI software growth is expected to outstrip traditional software within the machine vision market.

As the graph above shows, while AI software is coming from a much smaller base than far more established traditional software, we expect the AI software market to grow from around $114 million in 2024 to over $275 million by 2029, more than doubling in the next five years.

Strong growth forecast or bin-picking applications

Looking more closely at machine vison applications, we expect very strong growth in bin-picking applications. We define bin-picking as follows: The processes where a robotic system, guided by machine vision, identifies, selects, and picks up randomly arranged objects from a bin or container. This application includes sorting and handling in logistics, as well as picking and placing irregularly shaped items in machine tending or palletizing / depalletizing systems.

Bin-picking is especially prevalent in the logistics and warehousing industry, where machine vision is used in the sorting and dimensioning of parcels to guide robots to conduct often monotonous, tedious and repetitive tasks. 3D cameras capable of dimensioning can also help ensure parcels are correctly segmented for delivery and support strong growth in the 3D camera market overall. Labor inflation and shortages remain key drivers for automation, increasing the potential ROI of machine vision systems when automating warehouse tasks.

Particularly steep growth is forecast in bin picking applications over the next five years.

The market for bin-picking is expected to grow substantially, with a CAGR of 20.9% over the next five years. This will see the market size increase from around $200 million in 2024, more than doubling to over $500 million by 2029.

Final thoughts

A key factor providing such high growth for 3D cameras, especially in the longer term, is price declines for all 3D camera types over time. This allows customers to upgrade their systems to include 3D cameras and replace slower and less accurate 2D systems and is particularly prevalent for robots. One 3D camera can carry out the tasks of multiple 2D cameras, enabling faster and more compact robots to be developed.

The market for 3D cameras continues to grow, with many new vendors launching products each year. This creates price competition and helps to drive down prices, allowing more customers to implement 3D vision systems as part of their automation projects. Pricing is especially aggressive in China, where vendors are selling products at a cheaper price to gain market share from well-established western companies. This is also driving growth in the longer term.

We provide in-depth insight into data relating to the 3D camera market broken down by all four key technologies in our new ‘Machine Vision 2025’ report, which has just been published. This report and data set provide the most granular data on the machine vision market ever produced. We look at the market for 15 primary machine vision products, in 20 different industries, for nine different applications across 39 different countries. We supply this data in terms of revenues, units shipped and average selling prices (ASPs).